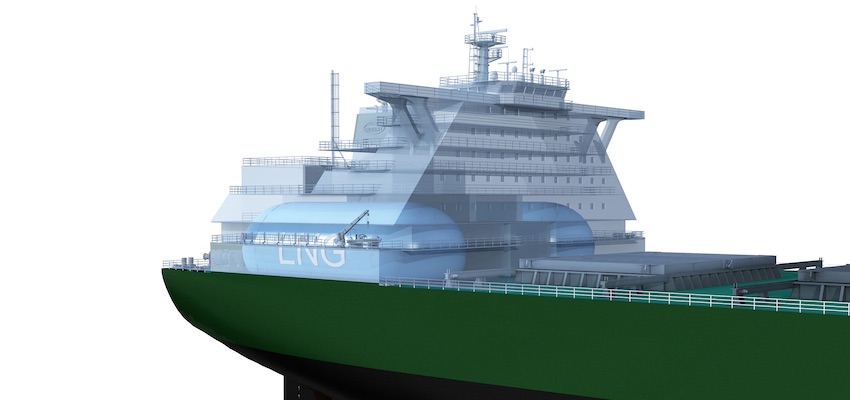

THE latest independent study from SEA-LNG confirms that liquefied natural gas delivers a strong return on investment for Capesize bulkers on the Australlia to China trade route, specifically a newbuild 210K DWT ore carrier.

The study illustrates strong returns on investment for LNG as a marine fuel on a net present value (NPV) basis over a conservative 10-year horizon. The modelling analysis is bolstered by payback periods of 2-4 years for the newbuild Capesize on this major ore trade corridor.

Commenting on the study Peter Keller, chairman, SEA-LNG, said, “The impressive results of this latest installment in our investment case series further underlines LNG’s position as a financially sound investment for deep-sea vessels, across a range of vessel specifications.

“Building up a robust foundation of leading knowledge, credible data, and proven understanding, is a core pillar of SEA-LNG’s mission to support shipowners and operators through the complex investment decision matrix they face in ensuring their vessels are compliant for both current and future legislation.

“All our studies prove LNG to be a safe, mature, and commercially viable marine fuel offering compelling returns on investment, superior local emissions performance, significant Greenhouse Gas reduction benefits, and a pragmatic pathway to a zero-emissions shipping industry.”

This study was designed to provide greater clarity for those investing in LNG as a marine fuel for large bulk vessels.

SEA-LNG commissioned the study as the fourth in a series of investment evaluations by simulation and analytics experts Opsiana.