RESEARCH firm Drewry has reported, in its latest Container Forecaster report, that the current supply chain turmoil will last longer than anticipated, forcing big upgrades to container freight rates and carrier profit forecasts.

“A longer than anticipated period of supply chain disruption has forced Drewry to once again raise our forecasts for container freight rates and industry profitability in the latest edition of the Container Forecaster,” said the firm’s senior manager of container research Simon Heaney.

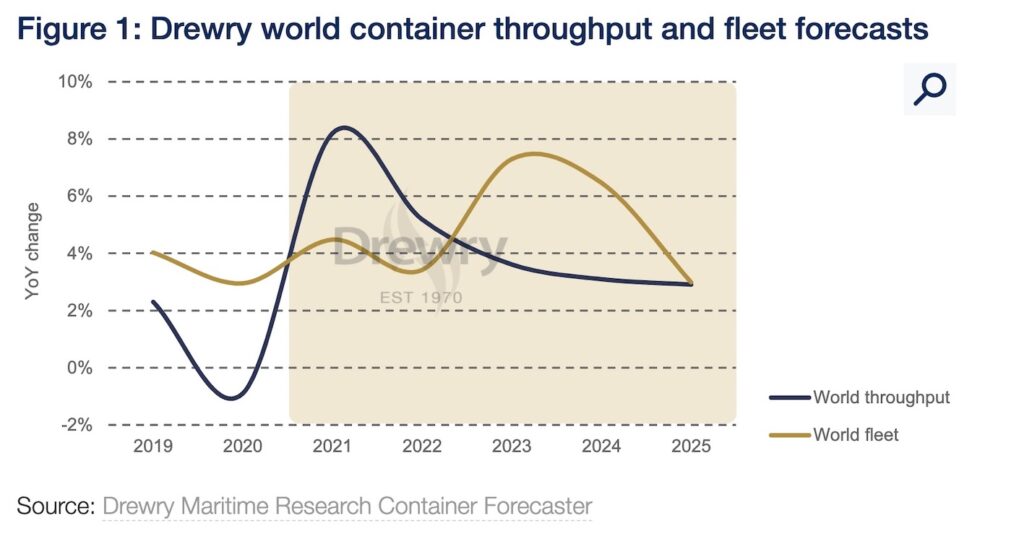

Analysts expects world port handling to increase by 8.2% this year, or 7.2% against pre-pandemic 2019. This is a downgrade on Drewry’s previous guidance of 10.1% given three months ago, since when disruption in the supply chain crisis has worsened as cases of Covid-19 temporarily shuttered some Chinese terminals, while extreme weather events have compounded the problem.

“Drewry does not expect to see operations normalise until the end of 2022,” Mr Heaney said.

“For 2022, we have retained our previous 5.2% guidance for global port handling, although rising inflationary pressures, partly as a direct consequence of the supply chain inefficiencies that have supercharged transportation costs, stand out as a downside risk.”

Drewry is predicting that fleet growth will lag behind demand growth this year and next, but that the story will flip from 2023 onwards as the recent frenzy of orders start to be delivered. The anticipated mismatch between supply and demand in 2023 presents a risk to carriers of overcapacity returning to the market.

“The real question is whether they will care? Three years of previously unthinkable and outlandish profits could very well desensitise them to such trifling concerns,” the firm said.

Stronger than expected spot rate movement in 3Q21 and a longer supply chain recovery timeline are behind Drewry’s upgrade the outlook for average global freight rates (spot and contract) for 2021 to 126%, which is an upward adjustment from 47% in its June forecast.

For 2022, spot rates are expected to decline, but there will be a significant increase in contract pricing, leading to an increase in average global pricing of about 6%.

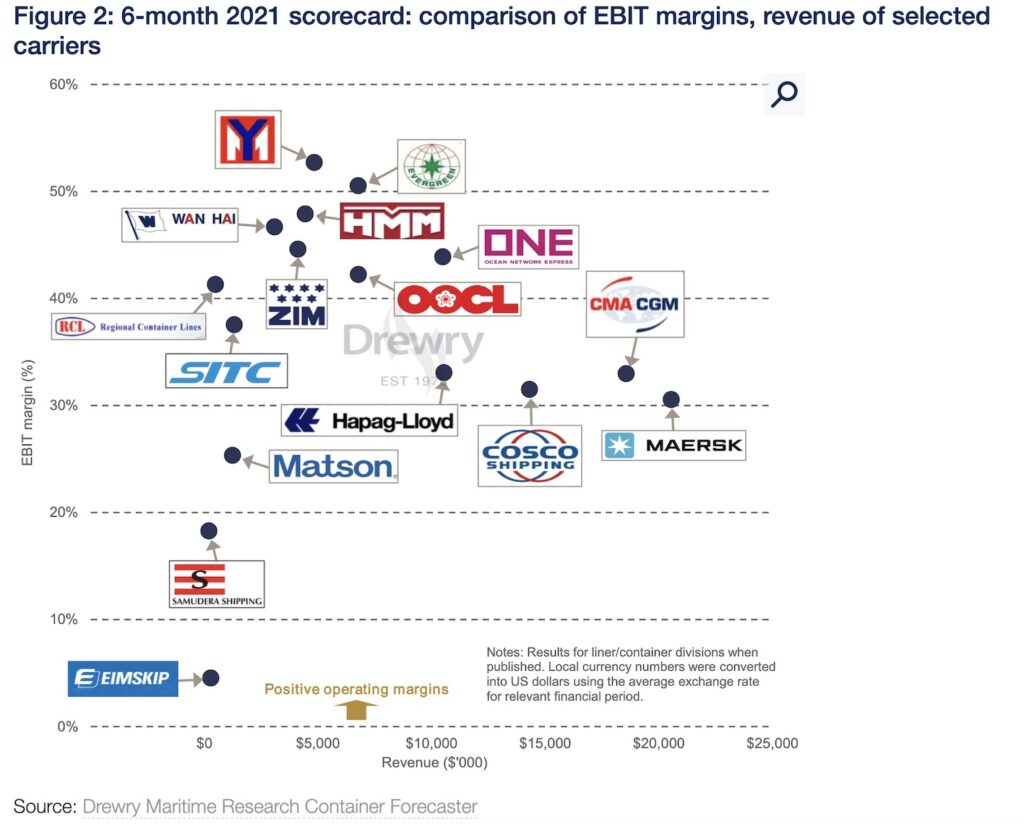

One of the consequences of all the above has been record carrier industry EBIT, which Drewry estimates topped $39.2 billion in 2Q21, an almost eleven-fold improvement from $3.6 billion profit in the same quarter a year ago.

“Increases in input costs, such as charter rates and bunker prices, had little impact. Every carrier that we track increased their margins compared to 1Q21, some beyond 50%,” Mr Heaney said.

Carriers are now expected to achieve EBIT of $150 billion in 2021, and slightly more again in 2022.

“To seasoned observers of the container market, typing these numbers on a page is frankly surreal, but while we get our heads around it, we still need to keep track of how carriers are utilising their windfall gains,” Mr Heaney said.

“Carriers have not been sitting on their profits, utilising them in a variety of ways, including debt repayment, shareholder dividends and large scale newbuild and equipment investment. This is important because, the more profits carriers make, the more they will have to justify their role.

“While they are unlikely to convince many shippers of their intentions, carriers have to at least demonstrate to regulators that they are doing everything in their power to improve the flow of goods.”

Drewry said with regulators breathing down their necks for evidence of unethical activity, lines are on the defensive and recent moves by some to cease further spot rate increases need to be viewed through the prism of a PR war.

“While that might seem to be a cynical take, in our view shipping lines are not to blame for this crisis. They are just the very lucky winners from this cruel lottery,” Mr Heaney said.

“It is not carriers’ fault that because ports keep them waiting, sailing schedules are in disarray and access to container equipment is limited.”

Neither are the ports and terminals at fault, according to Drewry.

“They have become parking lots for ships and boxes, because COVID made them less able to turn boxes efficiently, and then have them cleared from site quickly due to fewer truck drivers and low warehousing space.”

There are numerous risks to the forecast, mainly hinging on the speed of the supply chain recovery, that will dictate future revisions up or down.

While there are no easy answers to this extremely complex problem, Drewry’s rationale for the longer recovery period can be summarised as follows:

- We had expected more progress at this stage. The deteriorating situation makes us think the problem is much deeper-seated than feared, with the pandemic bringing forward latent crises within certain sectors;

- The consensus view from conversations with industry professionals is that end-2022 is a more likely timeframe, superseding previous expectations of a post Chinese New Year fix;

- Rising Delta cases have raised the risk for further logistics capacity to be restricted, either through more lockdown measures or stricter working protocols;

- US West Coast dockworker contract expiration next summer looms as a disruptive risk.

Drewry’s view is that carriers will continue to make splash investments over the short and medium-term, because they can, and because they are being closely scrutinised.

The firm’s combined projected industry EBIT for 2021-22 is about $300 billion, which it describes as “an extraordinary war chest to play with, while ongoing repairs to balance sheets will make carriers less sensitive to asset value inflation or concerns about being over-exposed when the market corrects”.