RESEARCH and consultancy firm Wood Mackenzie has released its forecast report for global gas and liquefied natural gas in 2022.

The firm believes that prices will fall if the Nord Stream 2 project is commissioned but suggests a “bumpy” year ahead.

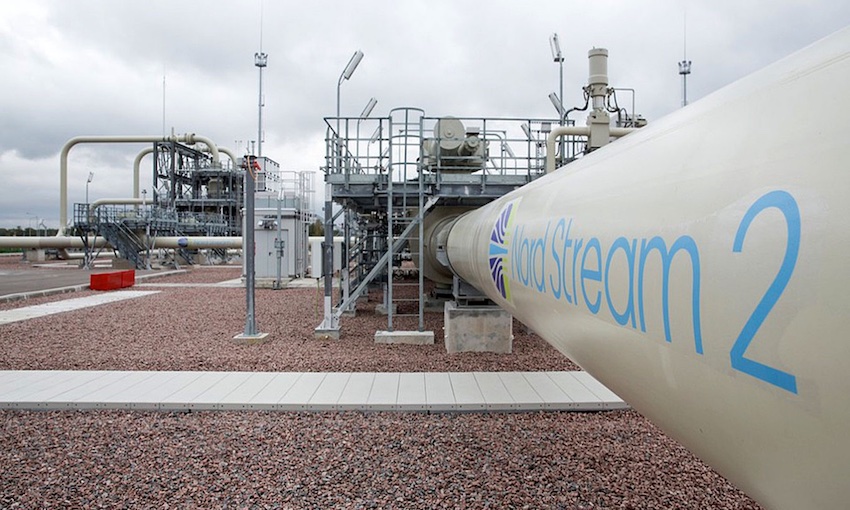

Nord Stream 2 is a Baltic Sea pipeline that will deliver gas from the world’s largest gas reserves in Russia to meet the growing demands of consumers in Europe.

Wood Mackenzie’s analysis suggests that at current levels of Russian exports and considering normal weather conditions, European storage inventories will get below 15 billion cubic metres (bcm) by the end of March, a record low. Prices will eventually come down as the winter is through, but requirements to refill storage facilities will be high, some 20-25 bcm more than last year.

“The commissioning of Nord Stream 2 might well be the only option to refill storage and avoid a repeat of the last year’s winter crisis,” Wood Mackenzie vice president Massimo Di Odoardo said.

“But things could get a lot worse. A cold winter could add up to 10 bcm of additional gas demand, pushing storage inventories to zero before the end of March. And the commissioning of Nord Stream 2 could be stopped altogether if tensions between Russia and Ukraine escalate, as the German government has recently warned.”

Normal winter weather and visibility on Nord Stream 2 commissioning would push prices down, although demand for storage (and high carbon prices) will maintain prices above US$15 per metric million British thermal units (mmbtu). But a cold winter and continued uncertainty about commissioning of Nord Stream 2 could see prices doubling, again.

Wood Mackenzie said oil-indexation levels are tipped to rise, potentially reaching 12% on a weighted average basis. Contracts starting before 2025 attract premiums while those starting after are priced at a discount.

Oil indexation in long-term LNG contracts has been on a declining trend for the past 10 years, a consequence of increased availability of uncontracted supply, more recently from Qatar, and reduced appetite for long-term contracts in favour of more spot exposure.

But 2022 will be a turning point for LNG oil-indexed contracts, with the level of indexation firmly on the rise. With Asian LNG spot prices expected to average close to US$15/mmbtu over the next five years, the current level of oil indexation (and oil prices) will result in a US$7/mmbtu annual average discount over spot LNG. Inevitably, demand for long-term contracts will increase, pushing oil indexation levels up.

Another trend noted by Wood Mackenzie is the momentum behind new LNG projects, but it says final investment decisions are unlikely to come from majors’ sponsored projects in 2022.

The firm expects 79 million tonnes per annum (mtpa) of additional LNG to take final investment decision over the next two years, including 33 mmtpa in North America, 16 mtpa in Qatar and 20 mtpa in Russia. And there is potential for upside.

In regard to demand, the firm says global gas demand will remain resilient in the short-term, but the role of gas in the energy transition will come under pressure as prices remain high.

“Despite strong economic growth in Europe, gas demand in industry and power is down 4% since the summer, compared to the past five years,” the report said.

Mr Di Odoardo said, “Eventually, though, higher prices will put pressure on demand. In Asia, the rationale to switch from coal to gas will diminish, as higher spot LNG prices will translate into higher oil-indexed contract prices.

“Meanwhile, investment in renewables and batteries will increase, limiting the headroom for gas demand to grow. And in Europe, where the move towards renewables is already underway, policy makers will look to accelerate the shift away from natural gas, as the recent EU proposal to support biomethane and hydrogen suggests.”

Green factors

Carbon-offset LNG flourished in 2021, with 28 cargoes announced, a five-fold increase compared to 2020. However, the enthusiasm appears to be fading, possibly because of high LNG prices but also a consequence of increased criticism to what had started to be seen as a greenwashing practice because of the low quality and costs of the offsets.

Wood Mackenzie believes this will push the LNG industry to focus on CO2 reduction across the value chain, which must be the ultimate goal, with offsets deployed only for unavoidable emissions.

More capital-intensive projects, including use of low-carbon power and/or carbon capture and storage, remain at an evaluation stage.

While gas is to be considered as transitional investment in the EU taxonomy, but this is no panacea for the gas industry, says Wood Mackenzie.

EU member states will be debating the taxonomy for sustainable investments after the European Commission released its latest version, classifying efficient unabated gas-fired power plants as transitional investments.

“This could prove to be a moment of truth for the global gas industry. Financial and non-financial investors will be able to increase their corporate ‘green scoring’ by investing in gas, including outside Europe,” the report states.

This may embolden other countries ton include gas too, particularly in Asian markets where coal still dominates.

“But the EU recognition of gas power plants as a transitional investment is no panacea for the gas industry,” Mr Di Odoardo said.

“Gas prices will need to come down to accommodate increased investments in gas use. And investments in gas infrastructure remain firmly outside the scope to classify for green credentials, let alone investments in supply.

“The road for gas to establish its role in the energy transition globally remains uncertain.”