FROM about June 2020 onward, commentators said that populations around the world were increasingly buying more goods. The Reserve Bank of Australia has now conclusively explained just how much of a boom in merchandise trade is currently being experienced in the world and in Australia in its Statement on Monetary Policy – May 2021.

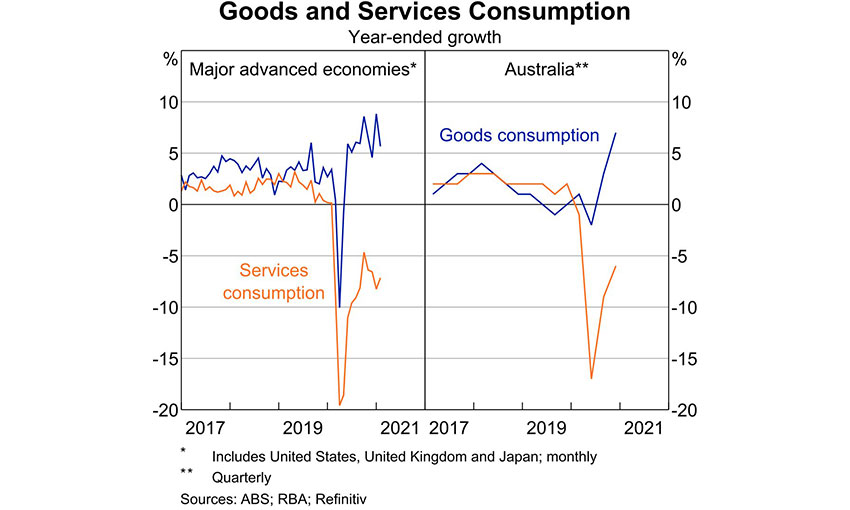

The blue line above shows goods consumption, which pretty much fell into a hole in the advanced economies around the world early last year. Merchandise trade pretty much translates into general cargo, which is mostly carried on container ships. That steep decline of merchandise trade equals a steep decline in cargo volumes.

That cargo-evaporation caused a lot of temporary changes in the ocean shipping industry. Freight rates were so low that shipping companies were even diverting their ships around the Cape of Good Hope to avoid paying Suez Canal fees. Of course, there were some blank sailings when the demand for the carriage of cargo dried up owing to a fall in consumer demand for goods and a fall in the supply of cargo because of COVID-induced production shortages in the manufacturing countries. Just like any other business, a shipping company will reduce its offerings during a time of low demand for its services or goods. It’s not reasonable to think – or argue – otherwise.

Incidentally, before we go any further, it’s worth noting here that a slow down in merchandise trade is not a risk to the ability of shipping companies to supply shipping services. It is, of course, a risk (and a serious one at that) to the ability of industries and countries around the world to buy the goods. It’s also a risk to the revenue-generating ability of shipping companies (no cargo, no freight revenue).

But it’s not a shipping supply risk. Sometimes commentators conflate the different risks.

Return of the trade

Anyway, as the graph in Figure 1 shows, consumers in developed countries around the world subsequently engaged in retail therapy with a passion. Consumers in Australia were no exception to that trend and they bought huge volumes of goods too. You can see from the graph in Figure 1 that the demand for merchandise trade is higher now than it was in the pre-COVID years.

But the ocean shipping industry has responded magnificently. The sector put a huge, idled, containership fleet back to work. There was about 3 million TEU worth of idled containership capacity at the beginning of the pandemic, it’s mostly been re-hired now. The demolition market for container ships has almost evaporated – in March hardly any container ships were scrapped. And non-specific tonnage (specifically, multi-purpose ships) have been hired to cope with the surge in demand.

Inevitably, swinging from one extreme (a huge decline in volumes) to a massive surge in volumes is going to cause complications. Commentators will no doubt point to a shortage of capacity and an increase in freight rates. But these are entirely normal in a very tight market and will almost certainly be resolved by the ocean shipping industry – even if demand does not decline – because the industry is investing in extra boxes and container ships. These current issues brought about by a tight market are temporary: they will resolve with the passage of time.

Commentators may also point to ships arriving off-schedule, industrial relations issues and congestion at port. These are problems, yes, but they are not shipping-created problems. Not even ships arriving off-schedule, as this is normally caused by port roblems at one of the previous ports of call.

Realise this: if an industry can experience a giant fall in demand for its services and it can then swing from that huge decline into a huge boom while coping all the time by tailoring its services to match market conditions then it is resilient.

The container shipping industry experienced a giant fall in demand followed by a huge boom in demand and all the time it tailored its offering to the market. The container shipping industry is resilient: there’s really no other reasonable way to look at it.

The same can’t be said for container ports. To be fair, they have been hit by factors outside of their control, by, for example, industrial action. And they were able to cope when the market hit a downturn.

But when the market abruptly swung from bust to boom, massive congestion resulted around the world, throwing ships off-schedule at great cost. And despite some sophistry in drawing a distinction between “on-window” and “off-window”, and “wait times” and “delays”, it is clear that ports have not been efficiently using their berths. That has led to ships having to sail at less-than-optimal speeds (whether that’s being forced to go fast or to go slow on the high seas) and ships have been put into a holding pattern upon arrival at port. Consequently ships have been delayed.

Ports have been causing supply chain delay, not ships.

Supply-chain issues

Despite the massive surge in demand for merchandise trade, the Reserve Bank has demonstrated that there have been fairly few supply chain issues across the Australian economy.

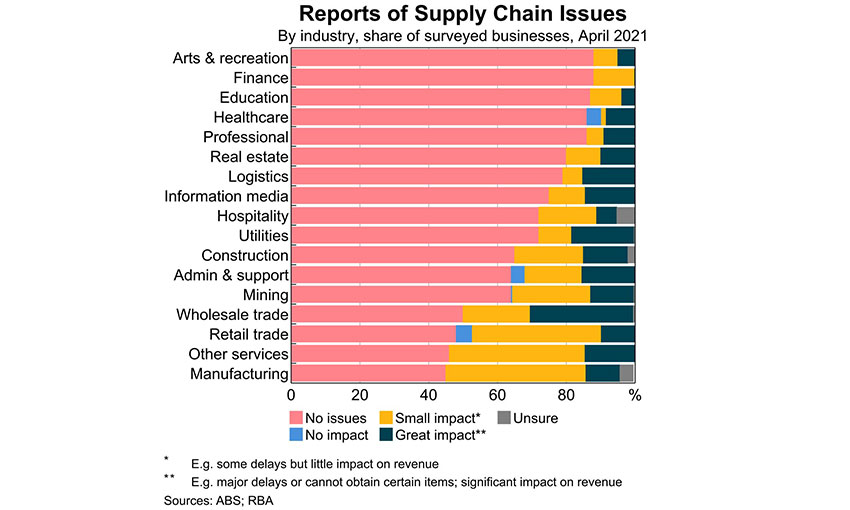

Now, bear in mind, few supply chain issues does not mean an absence of such issues. Certain sectors, products, and companies will inevitably have been exposed to supply chain risk during one of the biggest public health and economic crises in living memory. But, as the chart in Figure 2 (below) shows, overall, most of the Australian economy has not suffered supply chain issues.

The pinkish/salmon colour on the left means there have been no supply chain issues. The yellow colour shows business that have reported a small impact. The darkish green indicates that there have been great impacts. Overwhelmingly, the graph is pink. Overwhelmingly, the Australian business sector as a whole has experienced little to no impact from adverse effects from disrupted supply chains.

As the Reserve Bank points out, for most Australian businesses, supply chain issues have not been severe enough to affect operations materially. “Survey data indicate around 10 per cent of firms are experiencing severe supply chain issues, with smaller firms more affected than medium and large firms. For many firms, the effects of global supply delays early in the pandemic were largely mitigated by drawing down on existing inventories, as well as a significant decline in sales and orders. While some non-food retailers reported that shipping delays had resulted in longer-than-expected times to rebuild inventories since mid-2020, this issue has now largely been resolved,“ the Reserve Bank says.

Risk management is done at the level of the firm, not the sector

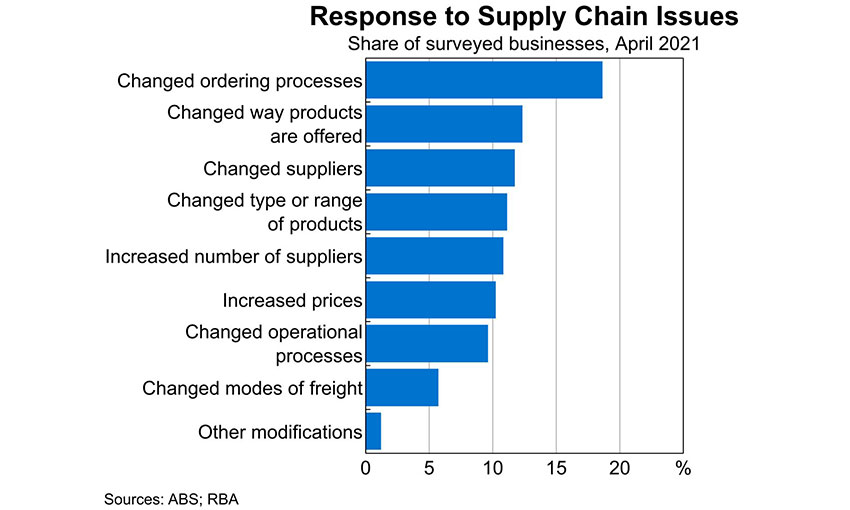

The Reserve Bank reports that Australian businesses have mostly responded to supply chain issues by changing their ordering processes. Further adaptions include changing the way that products are offered, and changing suppliers. Of interest is that changing the modes of freight is not a much-used option. See graph, Figure 3, below:

All of these graphs are surely proof as to the phenomenal resilience that container shipping offers: despite congestion, despite industrial action, despite a global pandemic unprecedented in living memory, despite a massive surge in the volume of merchandise trade, Australian businesses have not been badly affected because container shipping has literally delivered the goods.

Container shipping is resilient. It’s the only reasonable conclusion.

You may well have noted adverse remarks made elsewhere by various commentators arguing to the contrary. Well, you know now how to categorise those arguments.

Fake News!