THE Container Transport Alliance Australia’s initial analysis of the Australian Competition & Consumer Commission’s report on container stevedoring says the report reinforces the view that state governments need to be doing more to control terminal access fees through regulation and other measures.

The CTAA says the Container stevedoring monitoring report 2019/20, is clear on the issue of terminal access fees. The report says the ACCC is “concerned that the benefits of greater competition between stevedores to provide services to shipping lines will be eroded by increasing TACs”, but that “any regulation of these charges is a matter for state and territory governments.”

The CTAA said, “These ACCC comments fly in the face of commentary from some industry organisations who are focusing their advocacy efforts on trying to get the Federal Government to intervene… that is highly unlikely to occur, and perhaps such commentary gives false hope to many.

“The issue of whether rampant stevedore TACs should be regulated in some way or otherwise controlled is squarely a matter for state governments. Yet, to date, no state government has taken definitive action,” said Neil Chambers, director at the CTAA.

The report showed that stevedore revenues are up significantly from terminal access charges levied on road and rail transport operators.

Stevedores’ total revenues at monitored ports increased by $38.9m, or 2.8%, despite a significant drop in container volumes. Terminal access charges on aggregate have increased by $87.6m, or 51.9%, since 2018–19.

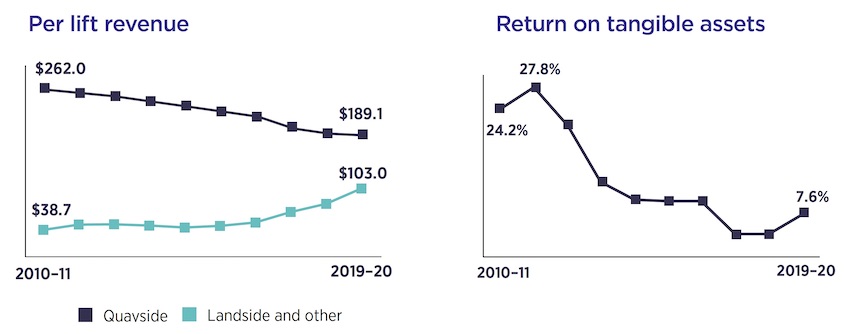

The average “per lift revenue” collected by stevedores from shipping lines for contracted vessel loading and unloading services (quayside revenue) has reduced by almost 28% in the decade between 2010-11 and 2019-20 (from an average of $262 per container lift to $189.10 per lift).

In turn these charges, and other port related fees, are recovered by shipping lines from exporters and importers including through terminal handling charges.

“These charges are effectively charges collected by shipping lines to recover from the shippers the cost of paying the container terminals for the loading or unloading of the containers and other related costs borne by the shipping lines at the port of shipment or destination,” the CTTA said.

“The question has to be asked, have importers or exporters witnessed any of these savings being enjoyed by foreign container shipping lines being passed through in the form of lower THCs in Australia? The answer is no.”

THCs in Australia charged by shipping lines to importers and exporters can range from over $400 for a 20-foot dry container to over $800 for a 40-foot reefer container.

“In contrast, average revenue collected by the stevedores from transport operators for landside services has risen by 266% in the decade from 2010-11 to 2019-20,” the CTAA said.

The ACCC Report notes that in the last year, “TACs on aggregate have increased by $87.6m, or 51.9%, since 2018–19.”

“So, exporters and importers and effectively paying twice for the same stevedore terminal services,” Mr Chambers said.

“Once through high and increasing THCs paid directly to shipping lines (who have not passed on any of their cost savings) and again when the TACs are passed through to exporters and importers by their transport providers.

The ACCC Report shows that on average the stevedores’ return on tangible assets has increased from 3.8% to 7.6%, while their profit margin (on average) has increased from 5.8% to 9.9%.

“This is largely off the back of significant increases in revenue collected through their TACs,”the CTAA said.

While increasing their profit margins, the ACCC reports that the stevedores’ average labour productivity fell by 4% and average truck turnaround times deteriorated.

“Higher charges, worse average service levels. Not a desirable trend,” the CTAA said.