DATA released by the International Air Transport Association shows that air cargo market demand continues well above pre-pandemic levels and that capacity constraints have eased slightly.

As comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID-19, unless otherwise noted, all comparisons below are to October 2019 which followed a normal demand pattern.

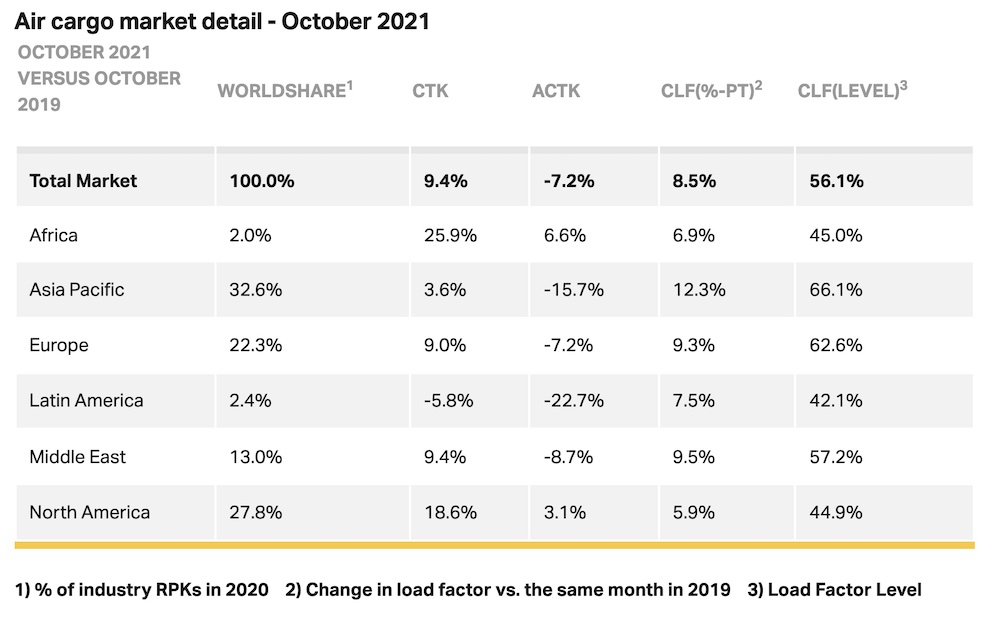

Global demand, measured in cargo tonne-kilometres, was up 9.4% compared to October 2019 (10.4% for international operations).

Capacity constraints have eased slightly but remain 7.2% below pre-COVID-19 levels (October 2019) (-8% for international operations).

Economic conditions continue to support air cargo growth but are slightly weaker than in the previous months.

The IATA notes several factors including supply chain disruptions and the resulting delivery delays have led to long supplier delivery times. This typically results in manufacturers using air transport, which is quicker, to recover time lost during the production process.

The global Supplier Delivery Time Purchasing Managers Index (PMI) reached an all-time low of 34.8 in October; values below 50 are favourable for air cargo.

Relevant components of the October PMIs (new export orders and manufacturing output) have been in a gradual slowdown since May but remain in favourable territory.

The inventory-to-sales ratio remains low ahead of the peak year-end retail events such as Christmas. This is positive for air cargo as manufacturers turn to air cargo to rapidly meet demand.

Global goods trade and industrial production remain above pre-crisis levels.

The cost-competitiveness of air cargo relative to that of container shipping remains favourable.

Willie Walsh, IATA’s director general said, “October data reflected an overall positive outlook for air cargo. Supply chain congestion continued to push manufacturers towards the speed of air cargo.

“The impact of government reactions to the Omicron variant is a concern. If it dampens travel demand, capacity issues will become more acute.

“Restrictions will not stop the spread of Omicron. Along with urgently reversing these policy mistakes, the focus of governments should be squarely on ensuring the integrity of supply chains and increasing the distribution of vaccines,” Mr Walsh said.

Asia-Pacific airlines saw their international air cargo volumes increase 7.9% in October 2021 compared to the same month in 2019. This was close to a doubling in growth compared to the previous month’s 4% expansion. The improvement was partly driven by increased capacity on Europe-Asia routes as several important passenger routes re-opened.

Belly capacity between the continents was down 28.3% in October, much better than the 37.9% fall in September.

International capacity in the region eased slightly in October, down 12.9% compared to the previous year, a significant improvement over the 18.9% drop in September.

IATA statistics cover international and domestic scheduled air cargo for IATA member and non-member airlines.

Total cargo traffic market share by region of carriers in terms of CTK is: Asia-Pacific 32.6%, Europe 22.3%, North America 27.8%, Middle East 13%, Latin America 2.4%, and Africa 2%.