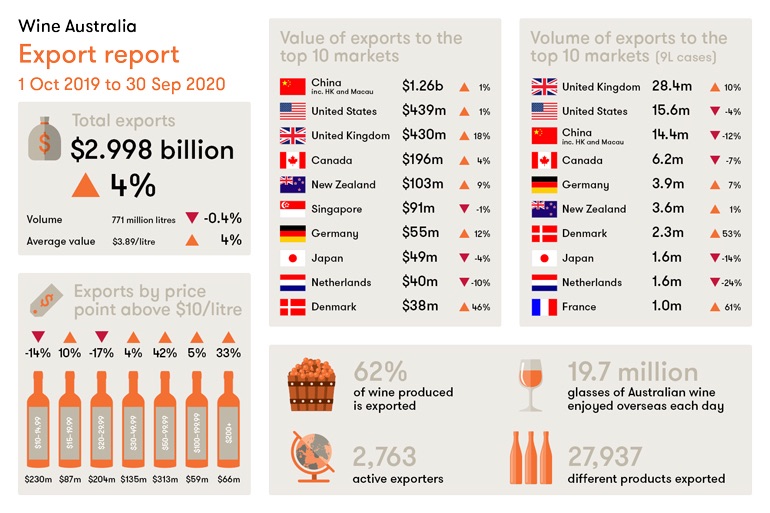

STEADY demand for Australian wine around the world has seen growth in value to all top-five exports markets and a 4% increase in overall value to $2.998bn, according to Wine Australia’s latest Export Report.

In the 12 months ended September 2020, the average value of Australian wine exports increased by 4% to $3.89 per litre, matching the growth of overall value. The volume of exports declined slightly by 0.4% to 771 million litres (85.7m cases).

Wine Australia CEO Andreas Clark said the overall value is at the highest level since exports reached $3bn in the second half of calendar year 2007.

“Despite the unprecedented disruption that we’ve seen in markets around the world, Australian wine export volume has held reasonably steady and it is particularly pleasing to see both the overall value and the average value of exports growing during these challenging times,” Mr Clark said.

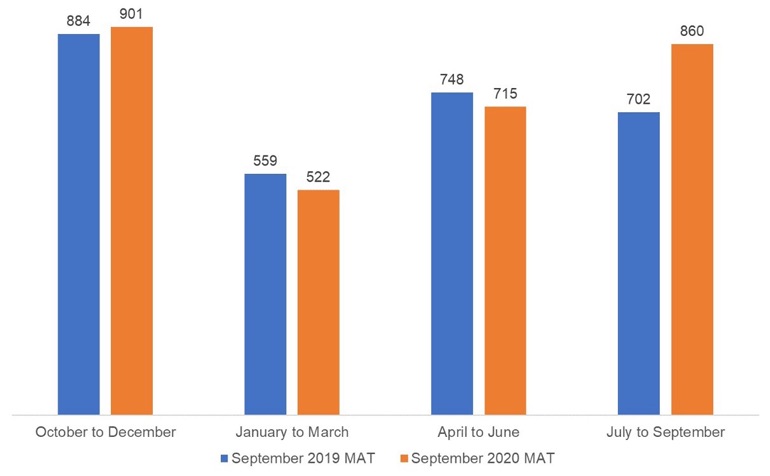

For the 12 months to the end of September 2020, the growth in value was predominantly driven by exports to the United Kingdom and mainland China. And that growth has been particularly strong in the last quarter of the 12-month period.

“During the July to September 2020 quarter, the value of exports increased by 23% compared to the same period in 2019, and this comes after declines of 4% in the April to June quarter and 7% in the January to March quarter,” Mr Clark said.

“Throughout the COVID-19 pandemic, there have been clear trends for wine consumption emerging around the world. While premiumisation has continued, there has also been a resurgence in commercial wines, and this is evident in the growth that we’ve seen in different price segments, where it was particularly strong at the low and high ends,” Mr Clark said.

“Different markets have had different trends. In markets such as the UK and US, growth was primarily at the commercial/value end, while in China growth for premium wines has remained strong this year.”

In the 12 months ended September 2020, Australian exporters shipped wine to 117 destinations.

The most significant growth came in exports to Europe, up 16% to $678m and over-taking North America in value terms for the first time since 2011.

The top five destinations by value all recorded growth. They were:

- Mainland China, up 4% to $1.2bn

- USA, up 1% to $439m

- UK, up 18% to $430m

- Canada, up 4% to $196m, and

- New Zealand, up 9% to $103m