Here is a summary of the government’s latest stimulus measures related to individuals and businesses as a result of the COVID-19 pandemic.

1. $66.1bn Stimulus Package

The federal government recently released a second, far reaching $66.1 bn stimulus package that boosts income support payments, introduces targeted changes to the superannuation rules, provides cash flow support of up to $100,000 for small business employers, and relaxes corporate insolvency laws.

The Prime Minister has warned that there are no “quick solutions” and that business should prepare for six months of disruption.

In summary

Business

- Tax-free payments up to $100,000 for small business and not-for-profit employers. An increase in the previously announced initial tax-free payments for employers to a maximum of $50,000. In addition to this, a second round of payments will be made up to a maximum of $50,000, accessible from July 2020.

- Solvency safety net – temporary six month increase to the threshold at which creditors can issue a statutory demand on a company from $2,000 to $20,000, and an increase in the time companies have to respond from 21 days to six months. Directors also are provided with temporary relief from personal liability for trading while insolvent for six months.

- Access to working capital – Introduction of a Coronavirus SME guarantee scheme protecting financial institutions by guaranteeing 50% of new loans to SMEs.

- Sole traders and self-employed eligible for Jobseeker payment – the eligibility criteria to access income support relaxed for the self-employed and sole traders.

- Temporary relief from some Corporations Act requirements.

Individuals

- Early release of superannuation – individuals in financial distress able to access up to $10,000 of their superannuation in 2019-20, and a further $10,000 in 2020-21. The withdrawals will be tax-free and will not affect Centrelink or Veterans’ Affairs payments.

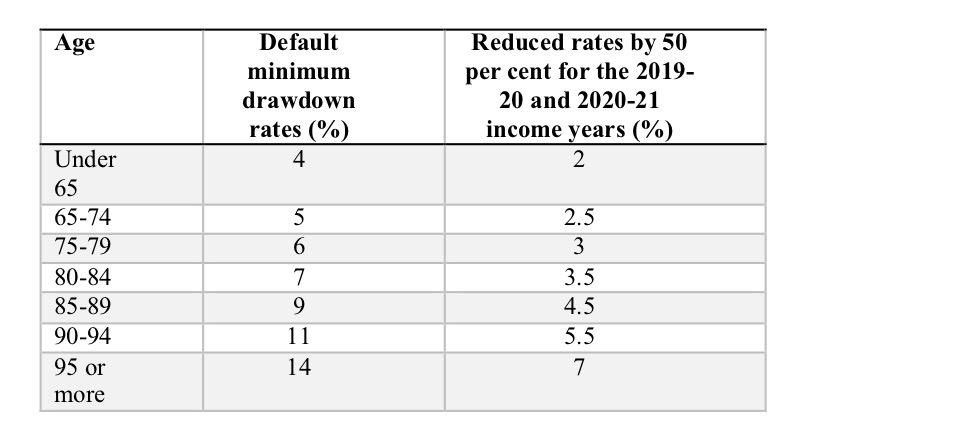

- Temporary reduction in minimum superannuation draw down rates – superannuation minimum drawdown requirements for account based pensions and similar products reduced by 50% in 2019-20 and 2020-21.

- Deeming rates reduced – from 1 May, superannuation deeming rates reduced further to a lower rate of 0.25% and upper rate of 2.25%.

- Supplements

increased, access extended and eased – for six months from

27 April 2020:

- A temporary coronavirus supplement of $550 will be paid to existing income support recipients (people will receive their normal payment plus $550 each fortnight for six months).

- A second one-off stimulus payment of $750 will be paid automatically from 13 June 2020 to certain income support recipients (in addition to the payment made from 31 March 2020).

- Eligibility for access to income support eased to include sole traders and the self-employed, and to those caring for someone infected or in isolation.

- Waiting periods and assets tests temporarily waived.

- Bankruptcy safety net – temporary 6 month increase to the threshold for the minimum amount of debt required for a creditor to initiate bankruptcy proceedings against a debtor from $5,000 to $20,000.

The government has flagged that additional stimulus packages will be required.

Support for business

Tax-free payments up to $100,000 for employers

- From: 28 April 2020

- Eligibility: Small and medium business entity employers and not-for-profit entities, with an aggregated annual turnover under $50m.

The government has increased the previously announced measures to provide cash flow support to business.

Now, eligible businesses with a turnover of less than $50m will initially be able to access tax-free cash flow support, with the minimum amount being increased to $10,000 and the maximum amount increased to $50,000 (previously $2,000 to $25,000). However, additional support will be provided in the July–October 2020 period so that eligible entities will receive total minimum support of $20,000 and up to $100,000.

In order for a business to qualify for this support it must have been established prior to 12 March 2020. The rules are more flexible for charities because the government recognises that new charities might be established in response to the pandemic.

The cash flow support measures will be provided in the form of a credit in the activity statement system. The support will be provided in two phases.

- The first phase ensures that eligible employers receive a credit equal to 100% of the PAYG amounts withheld from salary and wages paid to employees during the relevant period, up to the maximum amount of $50,000.

- The second phase ensures that eligible employers receive another series of credits, equal to the credits that were received under the first phase. For example, if a business received $40,000 of credits in the first phase it will receive a further $40,000 of credits in the second phase. These additional credits will be spread over two or four activity statement periods, depending on whether the employer lodges on a quarterly or monthly basis.

If a business pays salary and wages to employees but is not required to withhold any tax then a minimum payment of $10,000 will be made in the first phase and a further payment of $10,000 will be made in the second phase.

The credits are automatically calculated by the ATO and employers will need to lodge an activity statement to trigger the entitlement. If the credit puts the business in a refund position the excess amount will be refunded by the ATO within 14 days.

Businesses that lodge activity statements on a quarterly basis will be eligible to receive credits in the first phase for the quarters ending March 2020 and June 2020. Credits in the second phase will be available for the quarters ending June 2020 and September 2020. The minimum $10,000 payment will be applied to the first lodgement.

Businesses that lodge on a monthly basis will be eligible for the credits in the first phase for the March 2020, April 2020, May 2020 and June 2020 lodgements. Credits in the second phase will be available for the June 2020, July 2020, August 2020 and September lodgments. The minimum $10,000 payment will be applied to the first lodgement.

Eligibility for the measure will be based on prior year turnover. We will have to wait for the legislation for the finer details.

Not-for-profit employers, including charities, with an aggregated turnover under $50 million will also be able to access the cash flow support.

See: Cash flow assistance for businesses

Solvency safety net

A safety net has been put in place to protect businesses in temporary financial distress as a result of the pandemic by lessening the threat of actions that could unnecessarily push them into insolvency and force the winding up of the business. These include:

- A temporary six month increase to the threshold at which creditors can issue a statutory demand on a company from $2,000 to $20,000.

- The time a company has to respond to statutory demands will increase from 21 days to six months.

- For six months, directors will be provided with temporary relief from personal liability for trading while insolvent.

- See also bankruptcy safety net below

It will be more important than ever for business to stay on top of their debtors.

Debts incurred will still be payable by the business. Only those debts incurred in the ordinary course of the business will be subject to the safety net measures.

See: Temporary relief for financially distressed businesses

Access to working capital for SMEs – supporting lenders

The government has announced a Coronavirus SME guarantee scheme that will guarantee 50% of new loans to SMEs up to $20bn. These loans are new short-term unsecured loans to SMEs.

SMEs with a turnover of up to $50m will be eligible to receive these loans.

The government will provide eligible lenders with a guarantee for loans with the following terms:

- Maximum total size of loans of $250,000 per borrower.

- The loans will be up to three years, with an initial six month repayment holiday.

- The loans will be in the form of unsecured finance, meaning that borrowers will not have to provide an asset as security for the loan.

Loans will be subject to lenders’ credit assessment processes with the expectation that lenders will look through the cycle to sensibly take into account the uncertainty of the current economic conditions.

This latest measure builds on the previous initiatives to ensure small business can access capital, including:

- An exemption to the responsible lending obligations to enable financial institutions to provide new credit, credit limit increases, and credit variations and restructures;

- $15bn to the Australian Office of Financial Management to invest in wholesale funding markets used by small banks and non-banks to enable these lenders to support SMEs; and

- Australian Banking Association members will defer loan repayments for 6 months for small businesses (affected small businesses will need to apply for relief).

Sole traders and self-employed eligible for Jobseeker payment

The eligibility criteria to access income support payments will be relaxed to enable the self-employed and sole traders whose income has been reduced, to access support.

Temporary relief from Corporations Act requirements

The treasurer has been given a temporary instrument-making power to amend the Corporations Act to provide relief or modifications to specific compliance obligations.

ASIC has announced measures for those companies with a 31 December financial year that need to hold their AGMs by 31 May 2020, providing a two month no action period and enabling hybrid virtual AGMs.

Individuals

Early release of superannuation

From mid-April, individuals in financial distress will be able to access up to $10,000 of their superannuation in 2019-20, and a further $10,000 in 2020-21. The withdrawals will be tax-free and will not affect Centrelink or Veterans’ Affairs payments.

To be eligible to access your superannuation you need to meet the following requirements:

- you are unemployed; or

- you are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or

- on or after 1 January 2020:

- you were made redundant; or

- your working hours were reduced by 20% or more; or

- if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20% or more.

For those eligible to access their superannuation, you can apply directly to the ATO through the myGov website from mid-April.

Temporary reduction in minimum superannuation draw down rates

Superannuation minimum drawdown requirements for account-based pensions and similar products will be reduced by 50% in 2019-20 and 2020-21.

The upper and lower social security deeming rates will be reduced further. As of 1 May 2020, the upper deeming rate will be 2.25% and the lower deeming rate 0.25%.

Time limited fortnightly $550 ‘coronavirus supplement’

For the next six months, the government is introducing a new coronavirus supplement to be paid at a rate of $550 per fortnight. This supplement will be paid to both existing and new recipients in the eligible payment categories.

The payment will be made to those receiving:

- Jobseeker payment (and those transitioning to the jobseeker payment)

- Youth allowance jobseeker

- Parenting payment

- Farm household allowance

- Special benefits recipients

In addition, eligibility to income support payments will be expanded to:

- Permanent employees who are stood down or lose their job

- Casual workers

- Sole traders

- The self-employed

- Contract workers who meet the income test

The government notes that these criteria could include those required to care for someone affected by the coronavirus.

Asset testing has also been reduced and will be waived for six months. Income testing will still apply.

The payment is not available if you have access to any employer entitlements such as annual or sick leave or income protection insurance.

Second $750 payment to households

The government is now providing two separate $750 payments to social security, veteran and other income support recipients and eligible concession card holders residing in Australia (see the full list here). The payment will be exempt from taxation and will not count as income for the purposes of Social Security, Farm Household Allowance and Veteran payments.

- Payment 1 from 31 March 2020 (previously announced on 12 March): Available to people who are eligible payment recipients and concession card holders at any time between 12 March 2020 to 13 April 2020;

- Payment 2 from 13 July 2020: Available to people who are eligible payment recipients and concession card holders on 10 July 2020.

The payments will be made automatically to those that meet the criteria.

Bankruptcy safety net

A temporary six month increase to the threshold for the minimum amount of debt required for a creditor to initiate bankruptcy proceedings against a debtor will increase from $5,000 to $20,000. In addition, the time a debtor has to respond to a bankruptcy notice will be temporarily increased from 21 days to six months.

Where someone declares their intention to enter voluntary bankruptcy, the period of protection from unsecured creditors will be extended from 21 days to six months.

More: Temporary relief for financially distressed businesses

More information:

Joint media release with The Hon. Scott Morrison MP Prime Minister

Treasury: Support for Businesses

Treasury: Supporting Individuals and Households

2. $1,500 JobKeeper subsidy to keep staff employed

$1,500 JobKeeper subsidy to keep staff employed

- From 30 March 2020 for six months

- For employees employed at and from 1 March 2020

- First payments in first week of May 2020

Applies to:

- Based on comparable periods:

- Employers <$1bn that have experienced a downturn of more than 30%

- Employers >$1bn that have experienced a downturn of more than 50%

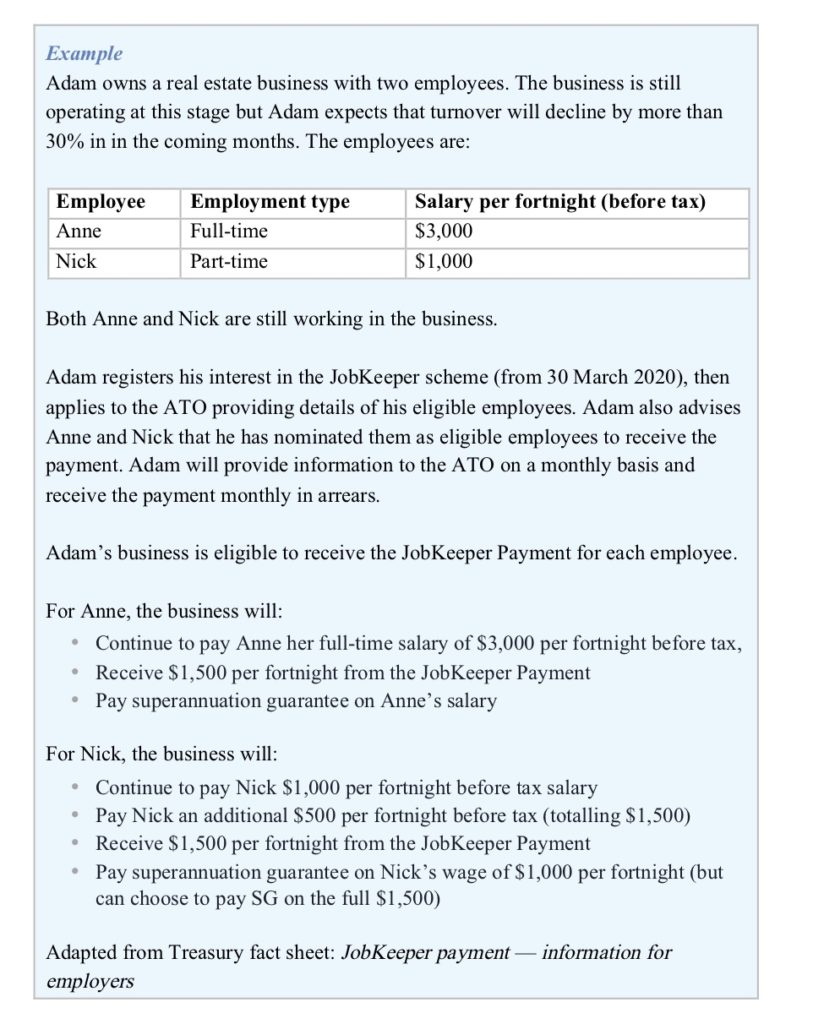

A subsidy of $1,500 per fortnight per employee, administered by the ATO, will be paid to businesses that have experienced a downturn of more than 30% (50% for businesses over $1bn).

The subsidy will be paid for a maximum period of six months (i.e. from 30 March 2020 up until 27 September 2020). It will be paid to eligible businesses monthly in arrears, with the first payments to employers commencing from the first week of May 2020.

To be a part of the subsidy, employers will need to ensure that their employees receive at least $1,500 per fortnight (before tax). See the example below.

Eligibility

There are two levels of eligibility; for employers and employees.

Eligible employers are those with:

- Turnover below $1bn that have experienced a reduction in turnover of more than 30% relative to a comparable period 12 months ago (of at least a month); or

- Turnover of $1bn or more that have experienced a reduction in turnover of more than 50% relative to a comparable period 12 months ago (of at least a month); and

- Are not subject to the Major Bank Levy.

Sole traders and the self-employed with an ABN, and not-for-profits (including charities) that meet the turnover tests are eligible for the JobKeeper payment.

Eligible employees are those who:

- Were employed by the relevant employer at 1 March 2020; and

- Are currently employed by the employer (including those who have been stood down or re-hired); and

- Are full time, part-time, or long term casuals (a casual employee employed on a regular basis for 12 months as at 1 March); and

- Are at least 16 years of age; and

- Are an Australian citizen, hold a permanent visa, are a Protected Special Category Visa Holder, a non-protected Special Category Visa Holder who has been residing continually in Australia for 10 years or more, or a Special Category (Subclass 444) Visa Holder; and

- Are not in receipt of a JobKeeper Payment from another employer.

While it appears that businesses without employees can potentially qualify for JobKeeper Payments, it is not clear at this stage what conditions will need to be satisfied.

How the support is calculated

The ATO will administer this program and will make the $1,500 payments based on payroll information. The payments will be made monthly in arrears, so it is essential that you ensure your business and your employees continually meet the eligibility criteria.

The business will continue to receive the payments for eligible employees while they are eligible for the payments. While the program is expected to run for 6 months, payments will stop if the employee is no longer employed by the relevant employer.

How the support is provided

To access the JobKeeper subsidy, you should talk to your accountant or adviser to assist you with the registration process and calculations.

If you want to manage the process yourself, you must:

- Register:

- Applications are not yet open. However, you should register your intent to apply for the JobKeeper subsidy with the ATO (here). ATO. The ATO will provide you with regular updates and advise you when you can lodge your application.

- Assess turnover:

- Ensure you have an accurate record of your revenue for the 2018-19 income year and for the 2019-20 year to date.

- Ensure you keep an accurate record of revenue from March 2020 onwards.

- Compare your revenue for the whole of March 2019 with the whole of March 2020.

- Measure the % decline in your revenue and ensure it has declined by more than 30%.

- If you are not eligible in March, you may become eligible in another month.

- Identify eligible employees:

- Nominate the employees eligible for the JobKeeper payments – you will need to provide this information to the ATO and keep that information up to date each month. The ATO will use Single Touch Payroll to prepopulate the information in most cases.

- Notify all eligible employees that they are receiving a JobKeeper payment. Employees can only be registered with one employer.

- Pay eligible employees at least $1,500 per fortnight (before tax). If an employee normally receives $1,500 or more per fortnight before tax the employee should continue to receive not less than $1,500 (before tax).

- Pay superannuation guarantee on normal salary and wages amounts paid to employees. If the employee normally receives less than $1,500 per fortnight before tax, the employer can decide whether to pay superannuation on the additional amount that is paid as a result of the JobKeeper program.

Sole traders and the self-employed can register their interest in applying for the JobKeeper payment with the ATO. These businesses will need to provide an ABN for the business, nominate an individual to receive the payment, provide the individual’s TFN and declare their continued eligibility for the payments. Payments will be monthly to the individual’s bank account.

By Fred Tortora CA, CTA

Director, Surry Partners

Corporate Accountants & Lawyers

Phone: (02) 9318 6400

Level 1, 483 Riley St, Surry Hill NSW 2010

www.surrypartners.com.au