IN global supply chains, manufacturers and retailers normally operate with months and years of forward planning. Carriers invest billions of dollars in vessels and other assets based on expectations for the next 25-30 years.

But no part of the supply chain is geared to manage the “extremes currently occurring”, according to the World Shipping Council, which represents the liner shipping industry.

“All parties are doing what they can to manage their way through this unprecedented pandemic. Unfortunately, they may unknowingly cause issues for other parties in the chain.

“To get through this time and stabilise supply chains all parties need to work together, taking a constructive approach rather than assigning blame.

“Closer dialogue is necessary for us all to better understand how to support each other and collaborate for better outcomes.”

The Council said to remove bottlenecks, container velocity must increase, forecasting must be more accurate, and transparency must increase across the supply chain.

“Ocean carriers are doing their utmost to manage the supply chain disruptions caused by COVID-19 and invite all parties to engage constructively to do the same,” the Council said in a statement.

The unparalleled disruptions to the international supply chain experienced over the last year are not caused by one party in the chain; they are the result of sudden and radical changes to the demand for goods due to the impact of the COVID-19 pandemic.

Ocean carriers are taking all available measures to improve the speed and efficiency of cargo movement including employing all available vessel tonnage.

When demand dropped some 20-30% in Q2 2020, carriers curtailed services and idled vessels. However, as cargo volume rose, carriers redeployed those assets as quickly as possible.

Alphaliner concluded at the end of 2020 that the inactive fleet was at just 2.5%, and more than half of that (62%) represents ships that are in shipyards for repair and other services.

Mid-January normally marks the beginning of capacity reductions in anticipation of the Chinese Lunar New Year holidays when factories in Asia close, but that is not the case this year, indicating that carriers will make best possible use of this time to clear volumes out of Asia.

Further, carriers are sharing capacity to maximise efficiency. Vessel sharing agreements are extremely important during times of high demand for vessel capacity. They ensure that all available slots are used even when an individual operator does not have sufficient demand from its customers for a particular sailing.

The pandemic has severely impacted access to containers and equipment. As inland transportation, port and warehousing operations have been hit by lockdowns, labour shortages and volume overloads, the positioning, use and return of containers within the global supply chain has slowed.

“In addition to maximising vessel capacity, carriers are working to improve access to container equipment,” said the Council.

“They are speeding the repositioning of excess empty containers and purchasing, leasing, repairing, and dispatching all available containers.”

The delays occurring on land have a direct impact on carriers’ ability to dock and unload ships according to schedule and on carriers’ ability to provide empty container equipment when and where it is needed.

“It is important that all users of the equipment, including customers and inland transportation providers, promptly return empty containers in order to make that equipment available for the next customer,” the Council said.

Despite actions to increase available vessel capacity, the demand for capacity far exceeds supply. As in any free market, this puts upward pressure on rates.

“Shippers and forwarders are understandably not pleased, but one must not forget that this is the same market fundamental that kept rates very low for several years.”

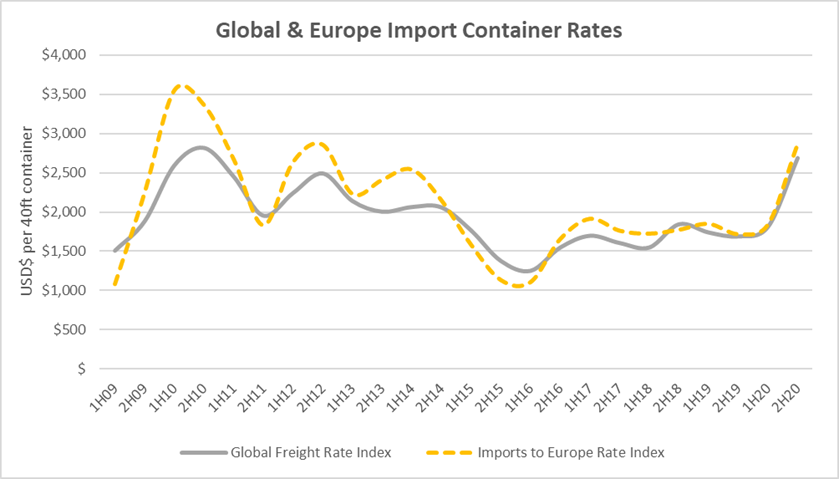

Drewry’s average global rate index for the past decade shows that rates rose in the second half of 2010 during the recovery after the recession years of 2008 and 2009. As vessel capacity and cargo demand came more into balance after that the rates declined steadily until reaching a low in 2016.