WITH vessel utilisation rates declining, ocean shipping analyst Sea-Intelligence said freight rates are due for a decline.

Sea-Intelligence CEO Alan Murphy said even though demand grew by 0.6% year-on-year in June, it doesn’t change the fact that it has been on a downwards trend ever since it spiked in peak season 2020.

“The more pertinent question, therefore, is how demand growth matches up against deployed capacity. A declining demand trend can be offset by a declining injection of capacity, especially in an environment where port congestion leads to significant vessel delays, and in turn results in capacity removal,” he said.

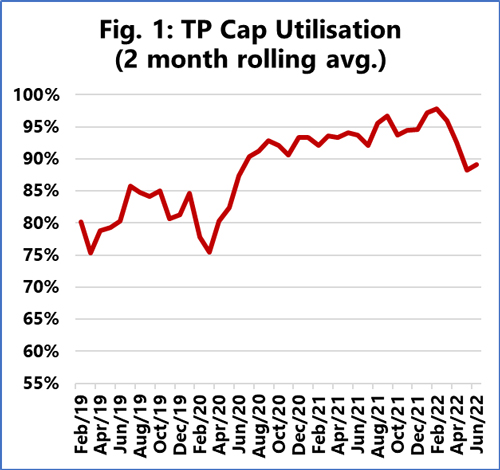

“When we look at capacity deployment on the major East/West trades, we can see that while demand growth is slowing, capacity growth is increasing at the same time. For trans-Pacific, the drop in vessel utilisation is shown [in the chart]. The sharp drop in May was sustained in June as well, with vessel utilisation around the 89% mark.”

Mr Murphy said there is a correlation between vessel utilisation and spot rates on the trans-Pacific.

“Basically, once utilisation gets into the 90-95% range for the trans-Pacific, it effectively means all capacity is fully utilised and spot rates increase dramatically,” Mr Murphy said.

“However, now that we have had two consecutive months where utilisation is below 90%, it is clear the market is no longer at a point which can sustain the extremely high spot rates. We also see a similar case on Asia-Europe and trans-Atlantic as well.

“The bottom line is that the average vessel utilisation on the major head-haul trades continues to be below the threshold which fuelled the record rate peaks over the past year and a half. As a consequence, spot rates will continue to decline.”