WHILE most tightening of ship emissions standards has occurred in the northern hemisphere, as urban encroachment in Australia continues, so will community pressure on authorities to act here.

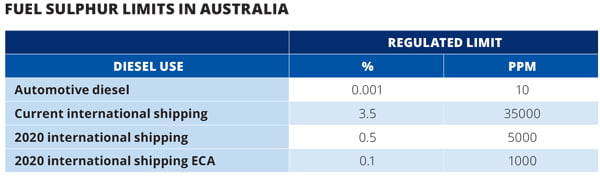

It is worth comparing Australian fuel sulphur standards from other emissions sources. While there has been a tightening of global fuel standards and emissions regulations for international shipping, the current Australian requirement for sulphur content in automotive diesel remains considerably more stringent (see table below). This is likely to attract further community attention in the future.

Impact on industry

Total annual marine fuel demand is around 400m tonnes and climbing. The global sulphur cap will have a significant impact and as suppliers attempt to meet this new mix of marine fuel demand there will be a price increase, possibly a significant one.

A recent survey of vessel operators by MIAL found average expectation of the cost differential between HSFO and compliant fuel was $250, and estimates ranged from $75 to $740 per tonne.

There are several compliance options available to shipowners, including using low sulphur fuel, alternative fuels such as liquefied natural gas and ‘drop in’ biofuels and renewable diesel, and exhaust gas cleaning systems – each having technical challenges, limitations and accessibility issues. The degree of uptake of each of these compliance options will have an impact on demand for low sulphur fuel and will influence supply and price. It is important to note the IMO fuel availability study, commissioned in the lead up to the decision on the sulphur cap implementation date, found the global refining industry has capacity to meet projected global demand.

Low sulphur fuel

Fuel low enough in sulphur to be compliant, in reality, can mean different things. Lower sulphur content can be achieved by blending low sulphur fuels and heavy fuel oil or further refining HFO, to produce gasoil (diesel). Sulphur content is just one of many specifications and there are some safety concerns around the use of blended fuels to achieve the 0.5% limit, the properties of these fuels and compatibility with existing marine diesel engines.

Work is underway to update guidelines relating to the relevant ISO specifications to address the safety concerns using new fuel blends.

In Australia, low sulphur diesel options are limited as is refining capacity. Along with some high sulphur heavy fuel oil and petrol, the major Australian fuel suppliers import one grade of diesel at 0.001% sulphur – this is automotive diesel – a costly option. Fuel suppliers have indicated they are planning to have low sulphur fuel oil available at selected Australian ports, but ship operators wanting access to this product need to communicate this early to ensure capacity.

LNG

LNG contains virtually no sulphur and, in recognition of the opportunities that LNG represents particularly for Australia, the number of newbuilds planned or operating within the Australian market is growing.

Perceived limitations are loss of cargo space due to the larger fuel storage area and current lack of distribution networks and bunkering infrastructure.

LNG has the added benefit of burning with about two thirds of the greenhouse gas emissions of diesel. LNG is a powerful greenhouse gas, however, and methane slippage has been flagged as an issue.

Biofuels and renewable diesel

The use of biofuels and renewable diesel presents a significant opportunity with little to no sulphur content. There are a variety of drop-in biofuels and renewable diesel products available that can be used in existing marine diesel engines. The main challenge for wide-scale adoption of these fuels is the scalability of production to meet the large volumes required.

* Angela Gillham is deputy CEO at Maritime Industry Australia

This article appeared in the May 2019 edition of DCN Magazine