MARITIME insurers North P&I and Standard Club have started discussions for a proposed merger that would create a new global marine insurer.

A statement said the new entity would be one of the largest providers of mutual cover in the maritime industry. Combined North P&I and Standard Club have more than 300 years of shared P&I heritage.

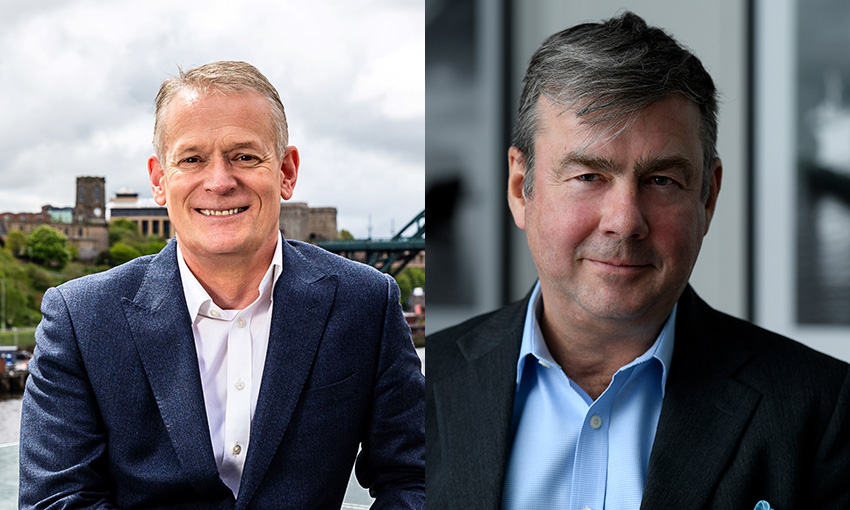

Standard Club CEO Jeremy Grose said the two companies have the opportunity to create one of the world’s leading and most influential P&I clubs with a broader diversified product range, scale economies and global reach.

“The merged club would maintain an unwavering commitment both to member service and to the International Group system and offer marine insurance products, services and solutions relevant to the broadest range of shipowners worldwide”, Mr Grose said.

“Acting as a powerful voice for shipowners and their best interests, the merged club’s market-leading knowledge and deep technical insight would focus on supporting the changing needs of shipowners.”

North P&I chairman James Tyrrell said with stronger financial resilience, the newly created club would be well-positioned to thrive in “all conditions”.

“In a changing and sometimes volatile maritime sector, North’s board has long recognised the potential value arising from considered and balanced consolidation in P&I,” he said.

“Choosing the right partner is the first critical step towards success.”

Backed by a strong capital buffer over regulatory requirements, the combined club’s capital strength would allow for significant reinvestment in enriching member services, innovative technology and more tailored and sustainable solutions for the longer term.

The formal announcement follows the approval of the proposal by the boards of both clubs and notification to principal regulatory authorities of their intention to merge.

A joint North and Standard Club working group has been appointed to evaluate how a combined entity would maximise value for members. The working group is following a structured methodology, allowing the case for a merger to be objectively explored and assessed by both clubs.

Standard Club chairman Cesare d’Amico said the ambition behind the merger is to deliver tangible benefits to shipowners.

“The boards of both clubs have played a key role in guiding and shaping the proposal,” Mr d’Amico said.

“Combining will provide greater financial resilience, efficiency and an even deeper pool of talent to maintain and strengthen the focus on service excellence and close member relationships for which both clubs are renowned.”

The proposed merger remains subject to the approval of the full mutual membership of both clubs and of all the appropriate regulatory authorities. Member voting procedures are anticipated to conclude by the end of May. If approved by the membership, the formal merger of both clubs is expected to complete by 20 February 2023.

North CEO Paul Jennings said that with several mergers in its recent history, North has an understanding of the range of benefits available to members from a well-planned and well-executed union.

“With histories which in 2022 add up to 300 years, the combination of these two unique advocates of mutuality, with their complementary cultures, ambitions and approaches, would build on the strengths of each club,” he said.

“The alliance of North and the Standard Club would deliver a compelling value proposition to take advantage of the opportunities and meet the challenges of digitalisation, recruitment, regulation and sustainability.”