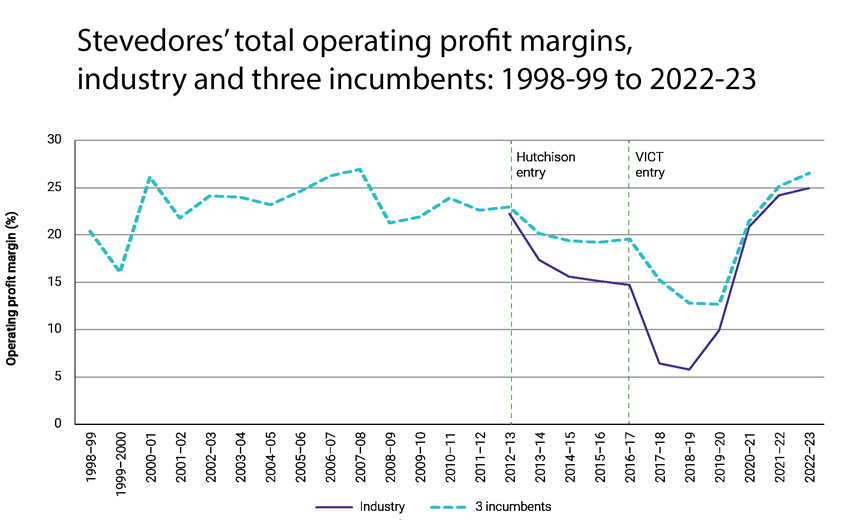

OPERATING profit margins of the container stevedoring industry in Australia increased to 24.9% in 2023, according to the Australian Competition and Consumer Commission’s Container Stevedoring Monitoring Report 2022-23.

This latest increase continues a trend of rising profit margins since a low of 5.8% in 2018-19.

While the industry profits have rapidly increased in the past few years, the ACCC said it is too soon to know whether the current profit margins are likely to be sustained.

The ACCC said stevedoring is a capital-intensive business and the large investments stevedores make are not steady or uniform, so the industry’s financial performance needs to be considered over a longer timeframe.

Australian stevedores recorded historically low profit margins before the covid-19 pandemic, and the industry’s average operating profit margin between 2012-13 and 2022-23 is 16%.

“While we have not formed a conclusive view on the stevedores’ profit margins, we are concerned by emerging evidence that the two new entrants of the last decade, Hutchison and VICT, are not constraining the incumbent multi-port stevedores as effectively as we had hoped,” ACCC Commissioner Anna Brakey said.

“Due to their focus on efficiency and cost minimisation, at least some shipping lines appear to be preferencing the same stevedore across multiple ports, which advantages Patrick and DP World.”

According to the report, Hutchison (which operates at Sydney and Brisbane) and Victoria International Container Terminal (Melbourne) may be less attractive to shipping lines than Patrick and DP World (which operate at Brisbane, Sydney, Melbourne and Fremantle), as they do not have a national presence.

Recommendations from the report

The ACCC believes several key reforms are needed to improve the efficiency of the container freight supply chain, despite the considerable improvements over the last two years.

The report says importers and exporters cannot access some of the key information they need to make business decisions, including how stevedore and empty container park fees will change over time. As such, the ACCC supports making it easier for cargo owners to determine all costs related to shipping lines’ services, including those charged by stevedores and empty container park operators.

The report also says importers and exporters need more protection against unreasonable detention fees. Shipping lines charge detention fees for continuing to use containers beyond an agreed period. The ACCC said these fees become unreasonable in circumstances where importers and exporters cannot return containers on time due to factors outside their control.

The ACCC also supports the Productivity Commission’s recommendation that Part X of the Competition and Consumer Act 2010 be repealed and replaced with a more targeted exemption for shipping lines.

Supply chain recovery

The report explains that the container freight supply chain operated more predictably in 2022-23, after two years of major pandemic-induced disruption.

Global vessel schedule reliability increased from 39.9% in June 2022 to 64.2% in June 2023. However, vessel schedule reliability is still worse than it was before the pandemic, and the ACCC understands that Australia may lag the global average.

Industry participants have told the ACCC that some shipping lines have restructured their Australian services to visit fewer ports and minimise the impact of potential delays.

“We think it’s likely that delays, lower container volumes, higher shipping costs and lower freight rates have all contributed to the decision by some shipping lines to streamline their Australian services,” Ms Brakey said.

While Australian freight rates have largely returned to their pre-pandemic levels by June 2023, the ACCC understands that at least some exporters have been paying higher rates due to the shortage of food-grade refrigerated containers.