NSW Ports has announced its intention to increase port charges and introduce a new incentive scheme at Port Botany from 1 July 2021.

The increase in port charges will be a CPI-based increase of 0.9% for all charges other than charges on empty containers for export.

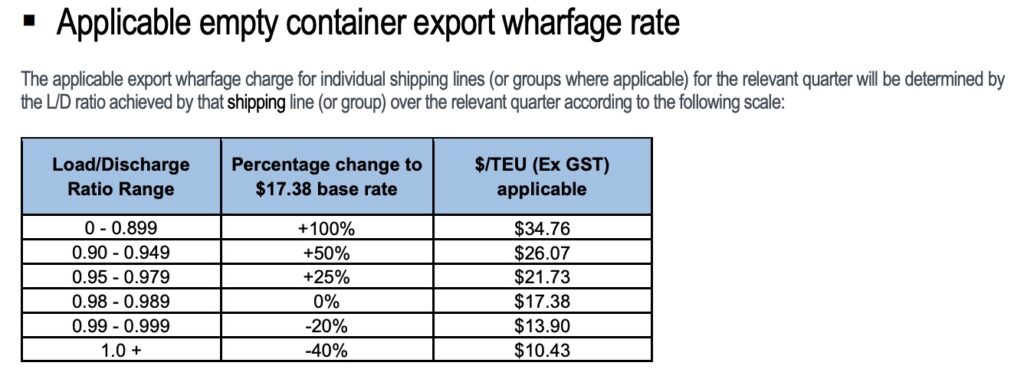

Under the new Port Botany Empty Container Incentive Scheme (ECIS), higher wharfage charges will be imposed for sub-optimal Load/Discharge ratios and conversely, wharfage rebates are awarded if L/D ratios are close to, or exceed, 1.0.

Empty container congestion became particularly acute in the last six months of 2020 when the L/D ratio across Port Botany fell to less than 0.93. In the three-year period from FY17-FY19 (inclusive) the annual L/D ratio was between 0.98 and 0.99.

“If the shipping industry sustains a L/D ratio significantly less than 1.0 over a period of time, it adds pressure to the empty container storage system and creates congestion,” said NSW Ports.

“A ratio of 0.98 over a year would add approx. 25,000 TEU of empty containers for storage in empty container parks which, in 2021, have a total capacity of approximately 60,000 TEU.

“Conversely, a sustained ratio close to 1.0 reflects a balanced supply chain,” said NSW Ports.

On a quarterly basis commencing on and from 1 July 2021, NSW Ports will calculate the L/D ratio for each shipping line (or group, in the case of commonly owned shipping lines).

The L/D ratio, within the given quarter, is a measure per shipping line (or group where applicable) of: the total number of full or empty TEU loaded at Port Botany (excluding transhipments) divided by the total number of full or empty TEU unloaded at Port Botany (excluding transhipments).

This calculation will be derived from the same manifest data from which volumes are derived for invoicing purposes.

Shipping lines will be invoiced, per normal procedures, for empty container exports at the base rate of $17.38 per TEU (excluding GST).

Following the end of each calendar quarter NSW Ports will advise each shipping line of their L/D ratio (or the L/D ratio of their group, as applicable) for that quarter and of the amount which is payable by or to that shipping line based on the wharfage charges set out in the table.

The move has been welcomed by the Container Transport Alliance Australia. Its director, Neil Chambers said, “CTAA welcomes any initiative to encourage shipping lines to continue to effectively manage empty container stocks in Port Botany and NSW, and to maintain a high repatriation rate.

“The difficulties experienced with landside empty container supply chain congestion in NSW since the COVID pandemic began has been caused by a build-up of surplus empties not moving through the port.”

This has led to significant empty container park congestion and an unsustainable build up of empty containers in transport yards and importers’ premises unable to be returned to any de-hire point.

“Thankfully, the “Load/Discharge” ratio through Port Botany has been closer to equilibrium or above in recent months as shipping lines have increased their evacuation rates to ensure that container stocks are relocated to Asia and elsewhere where they are urgently needed,” Mr Chambers said.

“But as Port Botany is predominately an import port, we all require the Load/ Discharge ratio to remain as close to equilibrium as possible to maintain a healthy balance in the empty stocks held at any point in time.”

Paul Zalai from the Freight & Trade Alliance said, “Any initiative that incentivises additional capacity available for exports is welcomed however preliminary member feedback highlights concerns that shipping lines may pass on any associated penalties as a part of a general increase in Terminal Handling Charges.

“We will actively monitor the results through our engagement with shipping lines and NSW Ports.

“Hopefully it will have the desired result to address the imbalance which is at the root of empty container build-ups that has generated supply chain inefficiencies and substantial costs ultimately borne by end customers, he said.