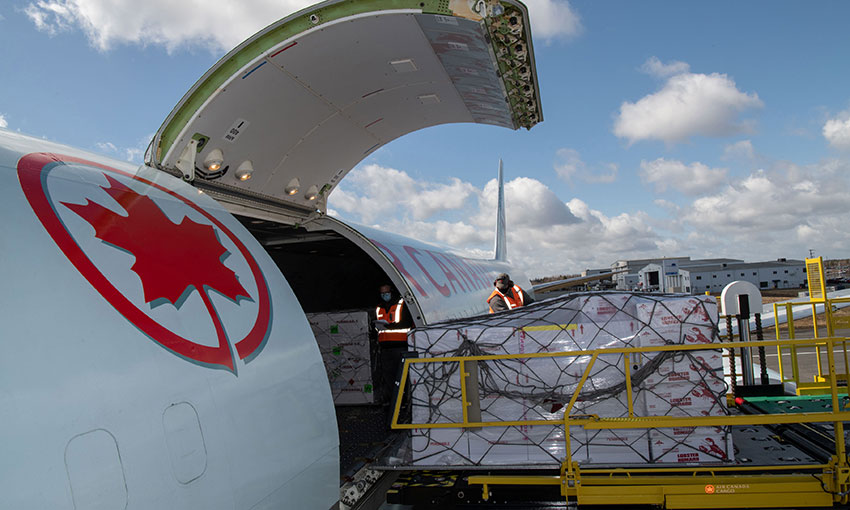

A NEW report by Infrastructure Partnerships Australia (IPA) shows the unparalleled disruption COVID-19 has wrought on Australia’s $125 billion air freight trade.

The latest edition of the IPA’s International Airfreight Indicator provide a detailed picture of the impact of COVID-19 on Australia’s multi-billion industry and the outlook for air freight trade as the world emerges from the pandemic.

IPA chief Adrian Dwyer said, “When aviation was all but grounded in early 2020, so too was our crucial supply chain capacity.

“Almost overnight, the pandemic grounded approximately 90% of international passenger flights – which had carried approximately four in every five air freight shipments in prior years.”

More than 730,000 tonnes of goods were carried by airfreight in 2020 – the equivalent of 15 fully loaded Boeing 747-8 freighters leaving and arriving in Australia each day.

While air freight only represents 1% of Australia’s trade volume, it punches well above its weight in value, accounting for one in every five dollars of our total trade – valued at almost $125 billion.

“Overall, air freight volumes declined by almost a third in 2020, with exports experiencing the most significant falls as a result of the pandemic and trade tensions with China,” Mr Dwyer said.

“In some cases, the cost of transporting goods by air freight increased up to 13 times pre-COVID rates.

“The biggest hit we saw during the pandemic was to air freight exports of predominantly high-value meat, fruits, vegetables, and diary bound for Asian markets,” he said, adding that exports of these goods declined by 35% in 2020 compared previous year.

Air freight imports of mainly electronics and online shopping goods were also hit hard – declining by 16%.

“As we seek to build back our supply chain connections, governments will need to grapple with the implications of an evolving international passenger network that is still subject to substantial disruption and constraint,” Mr Dwyer said.

“While major airports are likely to see a return of air freight as international routes reopen, the market is unlikely to go back to its pre-pandemic form, with smaller airports the most exposed.

“The growing demand for ultra long-haul passenger routes on top of an increasing concentration in air freight trade at our major airports could have significant impacts on the future of an industry that has historically flown under the radar.

“If governments want to capitalise on the economic potential of air freight trade over the coming decade, we need to shine more of a spotlight on the industry in our broader trade debate and freight network planning,” he said.