P&I CLUBS North and Standard Club have received all the approvals they need to merge as NorthStandard next month.

The marine insurers said the merger will position them as one of the world’s largest providers of mutual maritime cover.

They confirmed on Monday (23 January) they had received all the required formal approvals (legal, regulatory and competition) to finalise the merger and establish NorthStandard on 20 February.

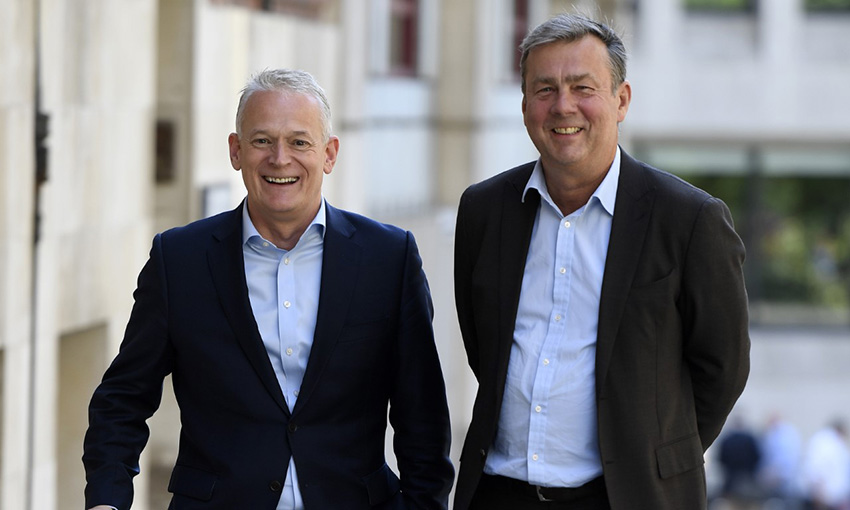

Standard Club CEO Jeremy Grose and North CEO Paul Jennings are to lead NorthStandard.

“With the formal merger date rapidly approaching, both clubs stand on the cusp of a fantastic opportunity through the formation of NorthStandard,” Mr Grose said.

“Thanks to its scale, the organisation will represent a significant new force in marine insurance, delivering the resilience members need from their P&I partner to meet the challenges and seize the opportunities of a rapidly changing shipping world.”

Mr Grose said Standard Club is looking forward to working with its members and clients as NorthStandard with broader skills and expertise, global network and financial resilience.

“The launch on 20 February 2023 means a new name and look for us, but more importantly, even better service, support and cover for our members, brokers and clients worldwide,” he said.

Mr Jennings said the expanded pool of talent as the companies merge will be a strategic and operational benefit.

“The formation of NorthStandard will support the recruitment and retention of the most talented individuals, helping us to deliver the highest levels of service, drive innovation and identify new opportunities for diversification,” he said.

“NorthStandard is fortunate to have such a strong pool of talent and will be the P&I mutual of choice for people – offering more options, opportunities and flexibility while retaining a long-established family ethos and culture.”

They said members of both clubs approved the merger in May last year.

When NorthStandard launches, it will reportedly have more than 300 years of combined P&I heritage and consolidated annual premiums of around US$750 million (more than $1 billion).