THE INDUSTRY is witnessing a major slump in the order-to-inventory ratio with high inventories but slower demands, according to the November edition of the Container xChange Forecaster.

This situation is causing a rippling effect across various stages of container logistics.

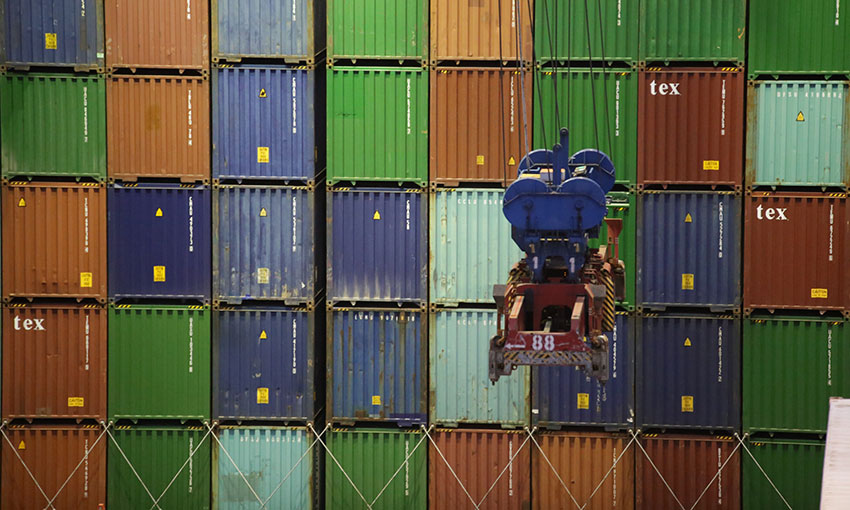

One of the glaring issues, which will impact container repositioning and container movement well into 2023, is insufficient depot space, according to the report.

Container xChange CEO and co-founder Christian Roeloffs said there is just not enough depot space to accommodate all the containers.

“With the further release of container inventory into the market (e.g., from the disposal of leasing fleets), there will be added pressure on depots in the coming months,” he said.

“This will be a key challenge for some and a competitive advantage for others in the business, especially in China because of the empty container repositioning there.”

This peak season retailers and companies are more cautious in their stock management strategy as they adjust to the shorter cargo delivery cycle.

Container xChange CEO and cofounder Johannes Schlingmeier said there is enough inventory with retailers.

“Once these inventories exhaust in North America and Europe, companies will order again, and demand for shipping capacity will pop back up,” he said.

“This won’t go back to max pandemic levels but certainly be back to the long-term average upward trend. What has happened now is that the cargo is ‘on time’ again and hence you’ll see a slowdown in new ordering as companies adjust to this more efficient turnaround times in ocean freight delivery.

“For container owners, this could potentially mean a rise in container storage fee by depots as more containers pile up to disincentivise longer staying containers at the depots.”