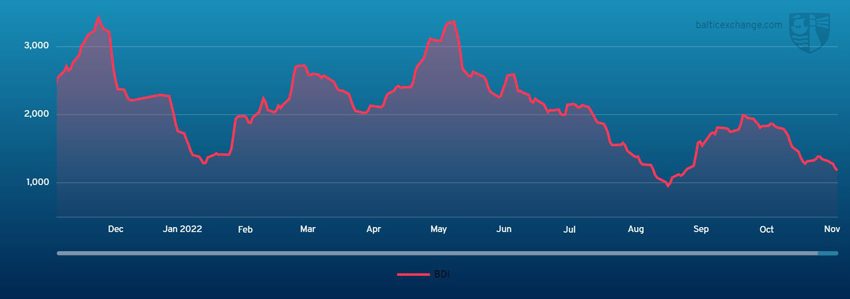

THE BALTIC Dry Index fell further this past week. It started at 1325 on Monday (14 November) and ended the week at 1189 on Friday (18 November).

Capesize

The Capesize market had little cheer this week as rates subsided throughout the week, albeit on the back of reasonable fixing activity. The Capesize 5TC now stands at US$9,305 – a decrease of 3502 week on week. The Atlantic region, particularly in the North, was showing some signs of resilience and positive sentiment early on in the week. This didn’t hold as rate levels declined towards the weekend with the Transatlantic C8 now trading at US$13,022 to the Transpacific C10 at US$7,918. West Australian miners were active throughout the week taking a good number of vessels in the spot market. Yet the fact that the C5 continues to drop is a telling sign of the health of the market. While there are expectations and reports of stimulus from China to help revive its economy, little signs of life have trickled down to the freight market. Without any such stimulus, it looks like an increasingly dire prospect ahead in the short term for the Cape market.

Panamax

Week on week the Panamax market witnessed only minor corrections. However, we end the week on a clear negative tone. Despite potential positive news for the market with the extension of Ukraine grain exports, tonnage count grew in the Continent and Mediterranean regions. This brought with it softer levels, as demand for Transatlantic trips offer minimal returns. Activity ex EC South America was fluid in the first half of thr week with some 10-20 December arrival fixtures concluded, but this tailed off as the weekend approached. A disappointing week in Asia with rates declining well in excess of US$1,000 for the longer rounds via NoPac and Australia, whilst fixing ex Indonesia saw even more spectacular falls. Rates are now discounted heavily by the smaller and mature tonnage. US$8,000 was agreed on a 76,000-dwt with bids well below this now. There was limited period activity but reports emerged of an 82,000-dwt delivery China achieving a shade below US$16,000 for one-year period.

Ultramax/Supramax

Brokers said it was an unexciting week as the Atlantic remained rather positional. The only strengthening was seen from the US Gulf, but mainly for trips to the Far East whilst Transatlantic runs did not offer such premiums. As the week closed positive sentiment was being seen from the East Mediterranean due to the extension of the grain corridor. Asia saw a steady stream of fresh enquiry from the south, but rates remained relatively flat as prompt tonnage availability remained strong. Further north it was a mixed week with little enquiry. Period activity was limited but a 60,000-dwt open Continent was fixed for 10-12 months trading at US$14,000. From the Atlantic, a 56,000-dwt was heard fixed delivery US Gulf for a trip to West Coast India at US$29,000. Elsewhere a 57,000-dwt fixed a trip delivery Spain redelivery West Africa at US$18,000. From Asia, a 63,500-dwt open Singapore fixed a trip via Indonesia to Thailand at US$10,500. A similar size open South China fixed a trip via Indonesia redelivery China at US$8,000.

Handysize

A very subdued week, certainly within the Atlantic. Brokers said limited fresh enquiry was seen in many areas and downward pressure generally remained across the board. Period activity was muted, but a small handy 16,000-dwt open Vietnam was heard fixed for three to five months trading at US$10,000. From the Atlantic, a 34,000-dwt fixed delivery Lower Baltic trip with grain to Morocco in the low US$14,000s. From the Mediterranean a 32,000-dwt open Italy was heard fixed for a trip to the Baltic at around US$16,000. From across the pond, a 34,000-dwt fixed delivery Recalada trip with grains redelivery West Coast South America at US$29,000. Asia similarly was unexciting, although mixed views appeared with some seeing a tightening of tonnage from the north. A 32,000-dwt open Penang was fixed for two-laden legs redelivery Singapore-Japan at US$10,000. Whilst another 32,000-dwt open South Korea was fixed at around US$10,000 for West Coast South America direction.

Clean

The Middle East Gulf has been relatively static this week on the LRs. The TC1 index has held in the mid WS170’s all week, but with Bahri week ending we are now hearing WS190 reported on subjects for this run. TC20 has begun to tick up from US$3,800,000 to US$3,975,000 with a US$4,000,000 deal widely reported. On the LR1s TC5 has been resolute in the WS212.5 region all week, with a trip west on TC8 also holding at the US$3,400,000 – US$3,500,000 mark.

AG MRs have struggled from lesser activity this week and freight rates have thus been chipped away at. TC17 shed 33.21 points to end up at WS336.43.

West of Suez, LR2 activity was a little better but didn’t prevent the TC15 index from dropping US$120,000 to US$3,050,000. On the other hand, the LR1s of TC16 have remained balanced at WS220 all week.

On the UK-Continent, MR freight levels saw a continued momentum upwards with strong demand from the UK-Continent and Baltic alike. TC2 rapidly climbed up to WS342.78 (+33.89) and TC19 pushed up 34.29 points to WS355.

In the US Gulf, MRs have been driven hard upwards this week – mainly fuelled by sentiment that there are still CPP volumes to be moved in November. TC14 jumped 88.75 points to WS245.83 and similarly TC18 hopped up to WS349.17 (+94.59). A run down to the Caribbean, TC21, has also risen significantly, breaching the US$1,000,000 mark and currently pegged at US$1,141,667.

The MR Atlantic Triangulation Basket TCE gained US$17,525 from US$34,458 to US$51,983.

On the Handymax, in the Mediterranean TC6 peaked at WS367.81 midweek and has then resettled down to WS363.13 at the time of writing. In the Baltic, TC9 has stepped up 29.28 points to WS525.71 supported by an active Cross UK-Continent. At these levels both TC6 and TC9 are returning over US$60,000 /day round trip TCE.

VLCC

The VLCC market continued the firmer trend this week with rates improving significantly on all the Baltic Exchange routes. 270,000 mt Middle East Gulf to China climbed 15 points (13.4%) to almost WS128 (a daily TCE round trip of US$96,400). The 280,000mt Middle-East Gulf to US Gulf (via the cape/cape routing) trip is assessed seven points (11.3%) higher than last week at WS69. In the Atlantic region, the rate for 260,000mt from West Africa to China rose 10.5 points (9.5%) to just over WS122.5 (a round trip TCE Earning of US$91,200 per day). The 270,000mt US Gulf/China shot up over US$1.65 million (12.9%) to US$14,646,875 (US$84,000 per day round trip TCE).

Suezmax

The Suezmax market in the West saw further gains in the rates, where 135,000mt CPC/Augusta is now trading 25 points up from a week ago at WS240 (a TCE showing a daily return of US$113,600). Meanwhile for the 130,000mt voyage Nigeria to Rotterdam market, rates steadily rose 10 points week-on-week to WS205 (a daily TCE round-trip of US$79,300). The 140,000mt Basrah/Lavera market firmed by four points to WS97.

Aframax

The Aframax market in the US-Caribbean region saw a stratospheric improvement this week with tonnage positions tight, unrelenting cargo volume, a storm brewing and delays at terminals – as well as in the Panama canal. This enabled owners to put the squeeze on charterers. The rate for 70,000mt East Coast Mexico/US Gulf gained an eye-widening 215 points to between WS612-615 (US$191,800 per day round-trip TCE) and overnight reports give details of WS700 being done by a Mexican charterer. In comparison, the 70,000mt Covenas/US Gulf voyage saw little reported fixtures. However, rates climbed 146 points on the back of other activity within the region to between WS525-527.5 (a daily round-trip TCE of about US$146,300). For the longer-haul 70,000mt US Gulf/Rotterdam voyage, owners were also able to apply pressure and the rate rocketed 100 points to between WS390-392.5 (a TCE of US$96,000 per day round-trip). Across the Atlantic, 80,000mt Hound Point/Wilhelmshaven saw big gains also with the rate 27.5 firmer at WS247.5 (a daily TCE of about US$96,200 round-trip). In the Mediterranean, which remained very active, the 80,000mt Ceyhan/Lavera route saw a significant improvement to the rate and firmed 97 points to between WS357.5-360 (showing a daily round-trip TCE of US$123,700).

LNG

LNG has taken a slight breather before winter with rates flat/softening across the routes. Uncertainty with Freeport hangs in the balance, which has allowed a small number of relets the chance to be pushed out for cargoes. This has lessened the tightness of tonnage of late. Although some ships have already begun to be fixed away and charterers are relying still on period terms to secure tonnage making spot still difficult. BLNG1g Australia-Japan saw a marginal increase to US$466,279, while both routes from the Atlantic Basin saw falls of around US$100,000 per day to settle at US$492,100 and US$472,313 for BLNG2G, and BLNG3g respectively.

LPG

The VLGC market has seen all-time highs this week, (a sentiment expressed almost weekly it seems) publishing at the highest levels since the routes came into publication. On BLPG1 in the middle east Aramco acceptances are due to come out, which will mean more December cargoes putting pressure on an already tight tonnage list. Sentiment has been bullish as fixtures continue to impress with rates rising to US$146.429 an increase of over US$12 for the week. A 79,000cbm vessel was fixed for an AG/East cargo of 44,000 LP on mid-December dates at USD 145. Out in the West, delays in Panama continue to wrestle with the available tonnage. Like in the east, we have seen record high publishing. BLPG3 is over US$200 for the first time since the Baltic published the route and it’s the same for BLPG2 at US$110.2. An 84,000cbm vessel was fixed for a Houston/East cargo of 44,000 LPG basis 24-25 Dec at US$199.