CLASSIFICATION society DNV’s latest report, Maritime Forecast to 2050, presents its new carbon risk framework enabling detailed assessments of fuel flexibility and “fuel ready” solutions, the economic robustness of fuel and energy efficiency strategies, and their impact on vessel design.

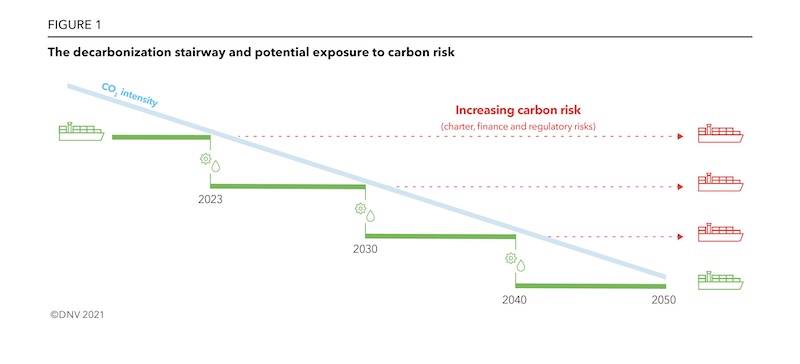

“Our intention is to help shipowners navigate the technologies and fuels and respond to the drive for decarbonisation by developing a ‘decarbonisation stairway’ reflecting the shipowner’s particular circumstances,” DNV said.

The report examines how the increasing pressure to decarbonise shipping, and the resulting shifts in how they are powered, may affect shipowners contracting new tonnage – with focus on practical solutions and fuel strategies to tackle the shift from conventional to zero/carbon-neutral fuels.

“The maritime industry will go through a period of rapid energy and technology transition that will have a more significant impact on costs, asset values, and earning capacity than many earlier transitions,” the report states.

“Shipowners are already experiencing increasing pressure to reduce the greenhouse gas footprint of maritime transport.”

The report provides an updated outlook on the regulatory and commercial drivers for decarbonisation of shipping. The three fundamental drivers in the coming decade include regulations and policies; access to investors and capital; and cargo owner and consumer expectations.

“The Initial IMO GHG Strategy currently drives policy development within international shipping, and the first wave of regulations will take effect from 1 January 2023 (i.e. EEXI, CII),” DNV said.

“We expect them to have a significant impact on design and operations of all ships.

“While all ships need to fulfill the minimum compliance requirements from the IMO, commercial pressure may push shipowners to aim for a leading position in decarbonisation, as we expect that poorly performing shipping companies will be less attractive on the charter market, and may also struggle to gain access to capital.”

The report also provides an outlook on ship technologies and fuels that could help shipping respond to the decarbonisation drive, introducing an updated timeline for the technical availability of selected alternative fuel technologies.

The report found that the energy and technology transition in shipping has started, with nearly an eighth (12%) of current newbuilds ordered with alternative fuel systems. This is an increase from the 6% reported in the 2019 edition of DNV’s Maritime Forecast to 2050.

“Except for the electrification underway in the ferry segment, the alternative fuels are currently still mainly fossil-based, and are dominated by LNG,” DNV said.

“There will be demonstration projects for onboard use of hydrogen and ammonia by 2025, paving the way for zero-carbon ships, and these technologies will according to our estimates be ready for commercial use in four to eight years.

“Methanol technologies are more mature and have already seen first commercial use. Fuel cells are far less mature than internal combustion engines, for all fuels.”

DNV’s research indicates that peak annual investments in onboard technology towards 2050 may reach US $60 billion.