GLOBAL Energy Ventures Ltd, an Australian-listed hydrogen export company, has announced the appointment of Andrew Pickering as the company’s new chairperson, effective immediately. Mr Pickering is a current non-executive director of the company.

As previously announced to the market on 18 October 2021, Mr Maurice Brand retired as chairperson following the company’s recent Annual General Meeting, after serving in this capacity since 24 November 2016.

Martin Carolan, managing director & CEO said, “The board of the company thanks Mr Brand for his valuable contribution to the company over the past five years and we wish him the very best in retirement.

“The management team will value his ongoing support as a shareholder in the company.

“Furthermore, the board is delighted that Mr Pickering has accepted the responsibility of chairing the board of the company.

“Mr Pickering brings extensive private and public company experience and leadership skills which will be invaluable in the next phase of the company’s development,” Mr Carolan said.

At its AGM, the company described 2021 as a “transformational year to reposition GEV as a genuine hydrogen company”.

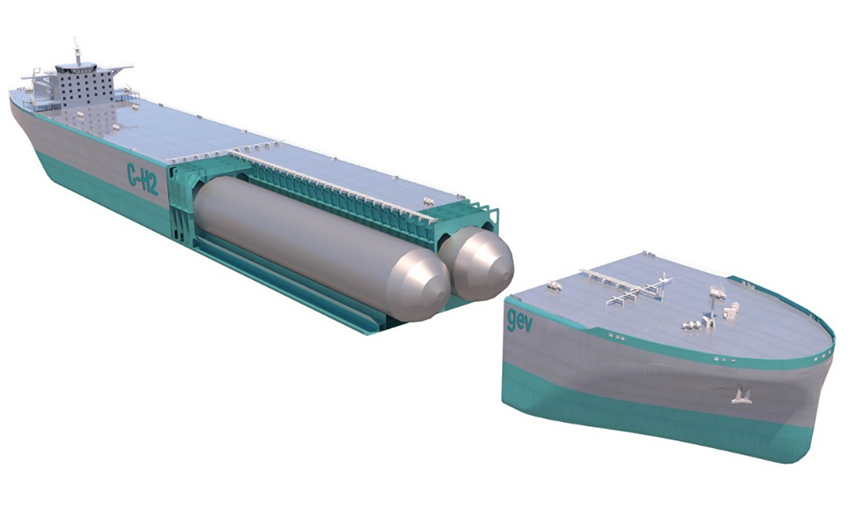

Over the course of the year, GEV achieved ‘Approval in Principle’ from ABS for two compressed hydrogen ship designs and has a US patent application for novel design. It also signed partnerships with Wartsila & Ballard for propulsion systems and has developed advanced ship engineering to secure the confidence of global partners.

In regard to hydrogen projects, the company commenced marketing its compressed hydrogen supply chain following scoping study in March 2021.

It also announced its Tiwi Hydrogen Export Project in October 2021, which involves a 2.8 GW green hydrogen export facility on the Tiwi Islands, Northern Territory. GEV says the facility’s integration with compressed hydrogen shipping provides an efficient “pipe to pipe” export demonstration project. The project currently has the support of the Northern Territory Government and Munupi land owners and the company expects a final investment decision in 2023, with first export in 2026.