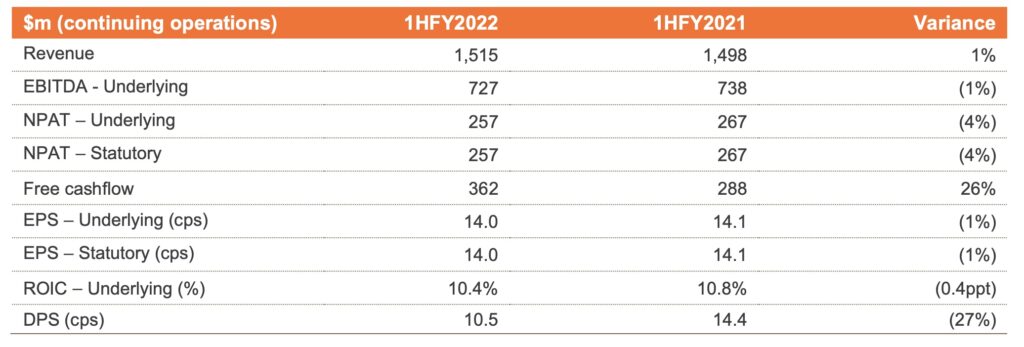

RAIL freight operator ASX-listed Aurizon has reported group EBITDA of $727 million for the half year ended 31 December 2021.

This is steady against the prior comparable period (PCP) (1HFY2021 of $738 million) with a solid performance from the bulk business (EBITDA up 1% or $1 million), with an increase in revenue due to the commencement of the CBH grain contract and the acquisition of the Newcastle Port Services business.

The group recorded higher coal earnings, up 4% or $12 million, with above-rail revenue increasing, despite lower volumes, due to the haul mix and CPI favourably impacting contract rates, as well as strong cost management.

The results include lower earnings performance (down 7% or $28 million) in the Aurizon network business due to the recognition of $49 million in historical Wiggins Island Rail Project (WIRP) fees in the prior period. Network tonnages were up 1%.

If the one-off $49 million WIRP payment from last year’s result is excluded, group EBITDA in 1HFY2022 would have increased 5% and Aurizon Network EBITDA would have increased by 6%.

Underlying Net Profit After Tax (NPAT) was $257 million, a 4% decrease compared to 1HFY2021.

Aurizon managing director & CEO, Andrew Harding, said, “The business has remained resilient and Aurizon’s earnings have remained stable despite challenges in markets that have seen reduced demand due to COVID-19 and customer-related issues.

“As an essential service, we have been able to continue to operate the freight supply chains sustainably that are vital for our communities, farmers, manufacturers and the resources sector.

“Cashflow from our operations remains strong at $362 million for the half. While we have adjusted our payout ratio as we prepare for completion of the One Rail acquisition, Aurizon continues to provide an attractive dividend return for shareholders,” he said.

Aurizon is targeting the completion of the One Rail acquisition in CY2022. This includes integration of the One Rail bulk haulage and freight assets into its bulk business, whilst also divesting the One Rail coal business that operates in Queensland and New South Wales.

One Rail will extend Aurizon’s national footprint to the Northern Territory and South Australia, with increased exposure to commodities associated with new-economy markets such as copper and manganese, as well as established agricultural commodities.

“Aurizon’s aim is to double the size of the bulk business by 2030 through organic growth and acquisitions, delivering a significant change in our portfolio mix and continuing to increase non-coal revenues,” Mr Harding said.