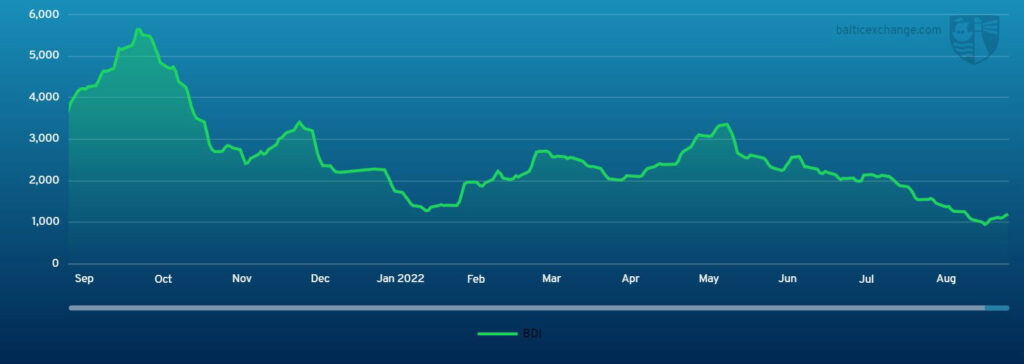

THE Baltic Dry Index appears to be continuing on an upward trend after last week dropping to its lowest point in more than a year. On Friday 9 September the index ended at 1213.

Capesize

The Capesize sector spent the week trundling along the market floor as the last few days’ brief revival of rates was quickly wiped out, returning the 5TC back to US$5-6k OPEX levels. On a more positive note, the Atlantic basin has begun to see a little more fixture activity with both Transatlantic and Fronthaul from Eastern Canada trades being heard. This has helped to flatten off the downward momentum and may even lead to an uptick in rates with the tight tonnage levels in the area. The Transatlantic C8 closed up 689 to US$3,411 to end the week.

In the Pacific, the trade continues to price in the US$5000-US$10,000 range. Flurries of fixing activity from miners are followed by their shops closing up for several days, leading the market silence to become deafening.

The Transpacific closed down -27 to US$7150 to end the week. There are some who still retain a little optimism in the market for a substantial bump in values yet they are few and far between. Q3 has been a disaster quarter for Capesize vessels and we can all only hope a traditional Q4 lift is around the corner.

Panamax

Following successive weeks of a dire market for players, some impressive gains were made in the Panamax market as the grain markets in both EC South America and NoPac came alive.

The Atlantic began the week slowly. However, by midweek a tight tonnage count for end September/early October arrivals in the South gave rise not just to the fronthaul trips, but also Transatlantic trips with Mediterranean positions getting hit at close to their offers. This is despite a relatively submissive mineral Transatlantic market. The Transatlantic route proceeded to yield in excess of a US$5,000 gain week-on-week.

Asia also saw remarkable gains. Indonesia coal demand remained strong all week with rates here slowly building. Ships delaying from last week’s typhoon, accompanied by a NoPac grain frenzy, lent support to tonnage in the north. There was talk at the end of the week of over US$20,000 being achieved for a NoPac round.

Ultramax/Supramax

A mixed week overall with a lack of fresh enquiry in the Atlantic and limited support in the Asian arena. As the week closed there was a widening gap between Owners and Charterers expectation in Asia. Period activity remained subdued but a 58,000-dwt open Japan fixed for one year’s trading at US$18,000.

From the Atlantic it was a relatively slow week. A scrubber fitted 63,000-dwt fixed a trip delivery US Gulf re delivery India in the mid US$20,000s. Elsewhere, a 57,000-dwt fixed delivery East Mediterranean redelivery South Korea at US$17,000. From Asia, there was limited support but a 55,000-dwt was fixed delivery Singapore trip via Indonesia redelivery China at US$17,000.

A bit more activity surfaced from the Indian Ocean. A 52,000-dwt fixed delivery Chittagong redelivery West Africa at US$15,000. A 63,000-dwt fixed delivery West coast India via Arabian Gulf redelivery Bangladesh at US$16,000. All eyes are focussed on the upcoming week to see if there will be a change in direction.

Handysize

With a rejuvenation in East Coast South America, the fortune of the BHSI changed and positivity returned for the first time in weeks. Brokers spoke of more enquiry and a lower draft in the River Plate being partially responsible. A 38,000-dwt was fixed for trip from Recalada to Ireland at US$23,000.

In Europe, there has remained a lack of visible activity, but a 38,000-dwt was fixed for a trip from the Continent to the US Gulf at US$13,500. A 30,000-dwt, meanwhile, was rumoured to have fixed a trip from La Pallice to South East Africa at US$13,500.

In Asia there has been a more balanced market. A 32,000-dwt was fixed from China to the West coast USA with an intended cargo of cement at US$20,000. A 36,000-dwt open in South Korea fixed for two to three laden legs at US$17,000 and a 37,000-dwt in Machong fixed for three to five months at US$18,500.

Clean

For the Middle East clean market it has been muted compared to last week. TC1 saw marginal gains over the week to WS280 (a TCE of US$63676 per day). A similar run on the LR2 going west, TC20, rose by just over US$140k per day ending at US$543,333 per day.

TC15 Skikda-Japan on the LR2s has seen a little improvement again, rising week on week to US$4,366,667 by the end of the week. There was little gain in overall TCE but a marked improvement from last week. The TC5 55kt Middle East Gulf to Japan saw a jump of WS25.71 points, settling on a firm footing and ending at WS330.71 at weeks end. The MRs saw the worst of it, losing a marginal WS7.5 points, but still sitting high at WS520 with a TCE per day of US$58,468.

Handymax routes in both the Mediterranean and the Baltic did opposite shifts with the Mediterranean gaining WS17.82 points to finish just at Ws180.63. This was a relatively healthy gain on the week off the back of decent activity. The Baltic route, meanwhile, saw a drop of WS18.57 finishing at WS347.14.

The MRs on the Continent had another good week with both the Transatlantic and West African routes seeing gains of around WS30 points. The TC19 closed at WS240.71 and TC2 at WS231.94

The US market has been active, despite labour day on the Monday. TC14 and TC18 US export runs rose by WS20 points for Transatlantic to WS183.33 with TCE of US$11,602 per day. The run to Brazil finished at WS274.17, a gain of nearly WS35 points.

VLCC

VLCC rates eased this week with the market coming off the recent high. For the 270,000mt Middle East Gulf/China route, the rate fell 4.5 points to the WS70.5 level (a round-trip TCE of US$31,700 per day). The rate for 280,000mt Middle East Gulf/USG (via Cape of Good Hope) slipped two points to between WS40-41.

In the Atlantic, rates for 260,000mt West Africa/China were three points lower than a week ago at a touch above WS71 (US$34,800 per day round-trip TCE). For the 270,000mt US Gulf/China market, rates dipped midweek, then started an upward trajectory on Thursday and were last assessed US$37,500 higher week-on-week at US$8.5875m (showing a round-trip TCE of US$30,700 per day).

Suezmax

Rates for 135,000mt Black Sea/Augusta stumbled this week with tonnage building up in the Mediterranean, which translates into a drop of 10 points since last week at WS181.5 (a round-trip TCE of US$73,500 per day). For the 130,000mt Nigeria/UKC trip, rates dipped a meagre 2.5-3 points to WS125 (a round-trip TCE of US$33,100 per day). In the Middle East, the rate for 140,000mt Basrah/West Mediterranean continued to hover around the WS65 mark.

Aframax

The Mediterranean market rates took a tumble. The rate for 80,000mt Ceyhan/West Mediterranean fell 32.5 points to WS157 (a round-trip TCE of US$30,600 per day). In Northern Europe, similarly the market fell with the rate for 80,000mt Hound Point/UK Continent dropping 25 points to WS152.5 (a daily round-trip TCE of US$30,100). The rate for 100,000mt Primorsk/UK Cont route was reduced by 21.5 points to WS181.5 (a round trip TCE of US$48,200 per day).

Across the Atlantic, the market has steadied for now with small improvements made. The rate for 70,000mt EC Mexico/US Gulf rose two points to between WS252.5-255 (a round-trip TCE of US$53,700 per day) while for the 70,000mt Caribbean/US Gulf trip the rate remained flat at between WS237.5-240 (a round-trip TCE of US$45,100). For the Transatlantic route of 70,000mt US Gulf/UK Continent, the rate climbed four points to WS210 (US$36,400 per day round-tip TCE).