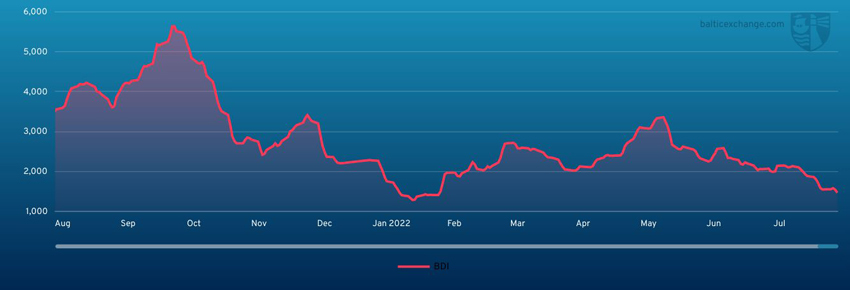

THE Baltic Dry Index continued its downward march over the past week.

It wound up on Friday at 1477 – the lowest point since the beginning of February this year.

The BDI started this past week at 1560 and climbed to 1592 on Wednesday before declining on Thursday and Friday.

Capesize

The Capesize market continues to dwell in the doldrums as any attempts to spark a rally were quickly dealt a hammer blow as the 5TC closed the week at US$10,898. This rate level is less than a third of the same time last year. The market was reasonably active this week.

The Pacific market had most of the majors requesting tonnage for their West Australia requirements. The C5 route fixed in the US$8’s throughout the week, closing out at US$8.085.

The Atlantic region saw several flurries of Brazil cargoes for both the Far East and north to the continent. Fixture levels on these routes sharpened throughout the week, while some Transatlantic cargoes were heard to have been pulled in a wait-and-see situation. The Transatlantic C8 lowered Friday -2,028 to settle at US$15,750, yet still a significant premium to the Transpacific C10 at US$7,209. The dire rate levels at this time of the year are a strong signal of the poor demand current being seen.

Panamax

The Atlantic was a stagnant affair this week.

With limited activity emerging, the North Atlantic drifted over the course of the week. Despite a few signs of better rates midweek, however these appeared positional and rates continued to ease.

EC South America also had a negative week, with September arrival cargoes few and far between, with talk of limited selling by the grain houses.

In Asia a smattering of NoPac fixtures emerged mid-week ranging from US$16,500 to US$17,500 for a 82,000-dwt tonnage delivery to South Korea. Australian coal destined for India continued to pay a small premium, with deals concluded in the range of US$17,500 and US$18,500, whilst most of the activity came courtesy of trips via Indonesia with redelivery to South China hovering around the US$14,000 mark over the week, although the latter part of the week had the rate pegged closer to US$17,000 as pressure grew in the south of the region with tonnage count appearing tighter.

Ultramax/Supramax

With the continued northern hemisphere holiday season and various national holidays in Asia, it was another lacklustre week overall. Limited fresh enquiry appeared in many areas leading to a build-up of prompt tonnage. However, as the week came to close, positive sentiment reappeared in Asia, which saw more interest from the south.

From the Atlantic, the US Gulf remained under pressure. A 63,000-dwt was heard fixed for a trip to China at US$23,750, while a 55,000-dwt was heard fixed delivery Santos trip to Algeria at US$29,500. From Asia, weaker sentiment saw a 56,000-dwt fixing delivery Kosichang trip via Indonesia redelivery South China at US$10,000, but as the week closed a 53,000-dwt was heard fixed delivery Singapore trip via Indonesia redelivery China in the high US$15,000s. A little more activity surfaced from the Indian Ocean, with a 63,000 fixing delivery Mombasa for a trip via South Africa redelivery Far East at US$22,750 plus a US$275,000 ballast bonus.

Handysize

In a week punctuated by national holidays, the negative sentiment of recent times continued seeing BHSI drop below 1,000 points for the first time since January. With brokers speaking of a continued lack of fresh enquiry across both basins, the outlook for the near future remains bleak for owners in what is being described as a summer lull.

In East Coast South America levels have been correcting day-on-day with a 35,000-dwt fixing for a trip from Santos to the Black Sea at US$22,000 whilst a 35,000-dwt open in North Brazil fixed basis a laycan of 20-30 August for a trip to Norway at around US$20,000. A 30,000-dwt was fixed from Santarem to Spain for an end of August laycan at US$15,500. In Asia, a 35,000-dwt was fixed from Shenzhen via South East Asia to West Coast Central America at US$18,000. A 32,000-dwt was fixed for two laden legs with Far East redelivery at US$22,000.

Clean

The Middle East Gulf has been lacklustre this week on all sizes. On the LR2’s tonnage has been plentiful, TC1 has been tested down again 20.32 points to WS211.56 and TC20 lost around half a million dollars to US$4.1m. The LR1’s have been relatively steadfast in comparison to their larger siblings and TC5 has held in the mid WS260s all week, with a trip west on TC8 only dropping US$70,000 to US$3.76m. On the MR’s, after another fairly major correction down (WS55 points), TC17 has settled out around WS282.5 at the end of the week.

In the west, the LR2’s of TC15 look to have been quiet all week and the index has subsequently dropped US$250,000 to US$3.75m at the time of writing. On the LR1’s WS230 has been repeated again several times this week, with the market stable on TC16 for the moment.

On the UK-Continent, action on the MR’s was at lower levels this week, allowing tonnage to accumulate in the region. TC2 has lost 18.05 points this week to end up at WS340.56 and TC19 is currently pegged at WSWS353.21 (-13.22).

The USG MR market abruptly stopped and took a major correction down this week. TC14 has lost about 150 points to end up at WS210 and TC18 has similarly shed WS150 to WS312.5. Due to the current bunker prices amongst other factors, this has taken the TC14 round trip TCE to less than half of what it was last week.

On the Handymax cross Mediterranean freight levels took a jump after enquiry came thick and fast at the beginning of the week. The TC6 index rose 82.5 points to WS347.5 taking the TCE for the run firmly back into the mid US$50,000’s round trip.

In the Baltic, TC9, despite a fixture reported at WS490 has continued along a just under WS500 all week, its currently pegged at WS499.64.

VLCC

VLCC rates have turned around this week with improvements seen across all regions. For 270,000mt Middle East Gulf/China, the rate recovered two points to just shy of WS60 (a round trip TCE of US$16,900 per day), while the rate for 280,000mt Middle East Gulf/USG (via Cape of Good Hope) gained 1.5 points to WS34. In the Atlantic, rates for 260,000mt West Africa/China gained 2.5 points to WS60 (US$18,800) per day round-trip TCE and 270,000mt US Gulf/China had US$287,501 added to the market level at US$7.418m (showing a round trip TCE of US$17,600 per day).

Suezmax

Rates for 135,000mt Black Sea/Augusta fell another nine points this week to about WS170 (a round-trip TCE of US$63,500 per day) while for the 130,000mt Nigeria/UKC trip, rates fell a further five points to WS122.5 (a round-trip TCE of US$30,200 per day). In the Middle East the rate for 140,000mt Basra/West Mediterranean continued sliding, dropping three points this week to just below WS63.

Aframax

The Mediterranean market slipped further, losing about 17% this week. The rate for 80,000mt Ceyhan/West Mediterranean fell 37 points to the WS175 mark (a round-trip TCE of US$37,500 per day). In Northern Europe the market remained relatively flat, with the rate for 80,000mt Hound Point/UK Continent static at WS185 (a daily round trip TCE of US$52,000) and for the 100,000mt Primorsk/UK Cont route rates gained a meagre single point to between WS223-224 (a round trip TCE of US$73,900 per day).

Across the Atlantic, the market has bounded back with the rate for 70,000mt EC Mexico/US Gulf rising a strong 75.5 points to between WS367.5-370 (a round-trip TCE of US$97,500 per day) and for the 70,000mt Caribbean/US Gulf trip the rate shot up 52 points to between WS330-332.5 (showing a round-trip TCE of about US$76,200). For the Transatlantic route of 70,000mt US Gulf/UK Continent, the rate rose 7.5 points again to WS270 (US$54,400 per day round-tip TCE).