THE International Air Transport Association released data for global air freight markets showing that full-year demand for air cargo increased by 6.9% in 2021, compared to 2019 (pre-COVID levels) and 18.7% compared to 2020 following a strong performance in December 2021.

This was the second biggest improvement in year-on-year demand since IATA started to monitor cargo performance in 1990 (behind 2010’s 20.6% gain), outpacing the 9.8% rise in global goods trade by 8.9 percentage points.

As comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID-19, unless otherwise noted, all comparisons below are to 2019 which followed a normal demand pattern.

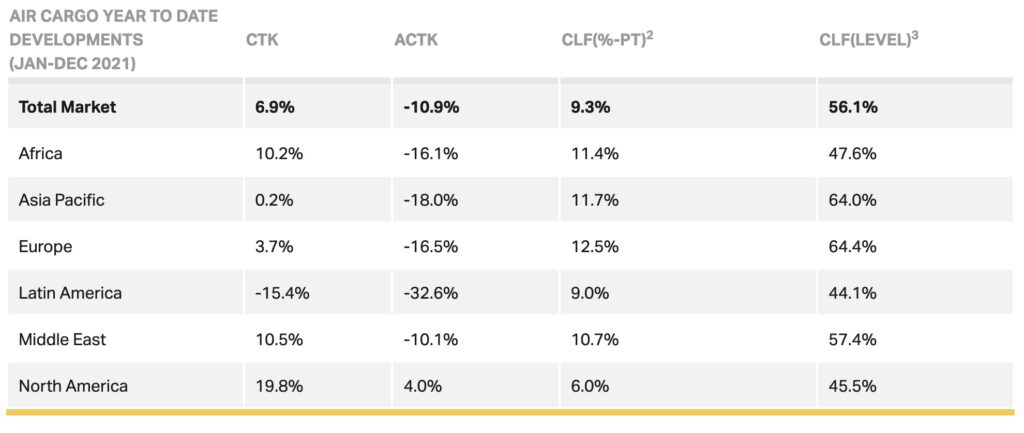

Global demand in 2021, measured in cargo tonne-kilometres (CTKs), was up 6.9 % compared to 2019 (7.4% for international operations).

Capacity in 2021, measured in available cargo tonne-kilometres (ACTKs), was 10.9% below 2019 (-12.8% for international operations). Capacity remains constrained with bottlenecks at key hubs.

Improvements were demonstrated in December; global demand was 8.9% above 2019 levels (9.4% for international operations). This was a significant improvement from the 3.9% increase in November and the best performance since April 2021 (11.4%). Global capacity was 4.7% below 2019 levels (‑6.5% for international operations).

The lack of available capacity contributed to increased yields and revenues, providing support to airlines and some long-haul passenger services in the face of collapsed passenger revenues. In December 2021, rates were almost 150% above 2019 levels.

Asia-Pacific airlines reported a rise in international demand of 3.6% in 2021 compared to 2019 and a fall in international capacity of 17.1%. In December airlines in the region posted an 8.8% increase in international demand compared to 2019.

Demand for goods manufactured in the region remains strong, including PPE. International capacity remained constrained in December down 10% compared to the same month in 2019.

Willie Walsh, IATA’s director general said, “Air cargo had a stellar year in 2021. For many airlines, it provided a vital source of revenue as passenger demand remained in the doldrums due to COVID-19 travel restrictions.

“Growth opportunities however were lost due to the pressures of labour shortages and constraints across the logistics system. Overall, economic conditions do point towards a strong 2022.

December saw a relief in supply chain issues that enabled an acceleration of cargo growth. “Some relief on supply chain constraints occurred naturally in December as volumes decreased after peak shipping activity ended in advance of the Christmas holiday,” Mr Walsh said.

“This freed capacity to accommodate front-loading of some Lunar New Year shipments to avoid potential disruptions to flight schedules during the Winter Olympic games.

“And overall December cargo performance was assisted by additional belly-hold capacity as airlines accommodated an expected year-end boost to travel.

“As shortages of labour and storage capacity remain, governments must keep a sharp focus on supply chain constraints to protect the economic recovery,” Mr Walsh said.