EUROPE-based logistics provider DSV has releasing a strong set of Q3 2021 numbers across all three divisions under “extraordinary market conditions”, according to the company.

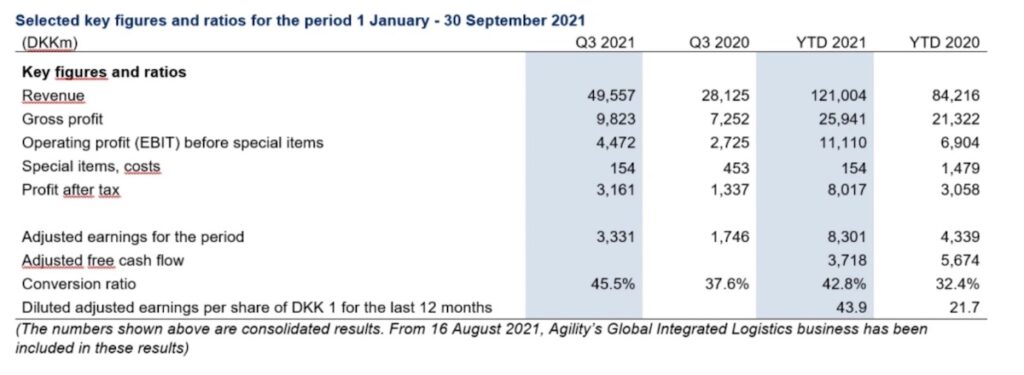

The results are illustrated by an EBIT growth for the group of 52.5% in Q3 2021 compared to the same period last year – excluding the impact of the acquisition of Agility’s Global Integrated Logistics business.

DSV is reporting good progress in the integration of Agility’s Global Integrated Logistics business, which became part of DSV in August 2021. The operational integration is expected to be fully completed by Q3 2022.

DSV also announced an expansion of the executive board, with Jens Lund taking on the new role as group COO and deputy group CFO Michael Ebbe has been appointed new group CFO.

Jens Bjørn Andersen, group CEO said, “The transport markets continue to be characterised by disruption and imbalances causing extraordinary challenges for both our customers and us”.

The company has upgraded its outlook for 2021. EBIT before special items is expected to be in the range of DKK (Danish krone) 15,250-16,000 million.

Once fully integrated, Agility’s Global Integrated Logistics business is expected to contribute approx. DKK 3000 million (previously 2800 million) to the combined EBIT before special items on an annual basis.

A separate company announcement about the launch of a new share buyback program of up to DKK 5000 million has also been issued. The program will run until 8 February 2022 or earlier if finalised.